Daily Brief, Sep 19: Economic Events Outlook – SNB & BOE Set to Release Rate Decision

Today we have three other major central banks due to report their monetary policy decisions: the Bank of Japan, the Swiss National Bank, and

Recalling FX Leaders September 18, Economic Events Brief, the market traded precisely in line with our forecast. The US dollar spiked lower as an initial response to the rate cut but suddenly reversed to trade bullish later as investors started taking profits on the widely expected outcome.

Likewise, the precious metal GOLD also spiked upward, but later fell sharply to place a low around 1,485 area.

On Thursday, the US dollar gained support following the Federal Reserve interest rate cut decision, as expected. However, the forward guidance is extending pretty mixed signals about future easing.

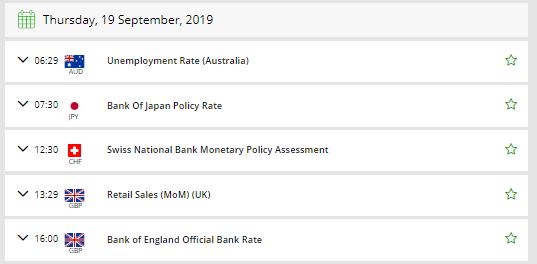

Watchlist – Top Economic Events Today

It’s a day after the FOMC meeting, which was sort of mixed in nature. Fed cut the rate from 2.25% to 2%, but FOMC members voted for no additional rate cuts in 2019.

Today we have three other major central banks due to report their monetary policy decisions: the Bank of Japan, the Swiss National Bank, and Norges Bank of Norway. The BOJ rate decision is already out though, let’s see what they did.

JPY – BOJ Monetary Policy Decision

The Japanese yen reached an almost three-year high in late August which had put the Bank of Japan in a tough position. Over the past three weeks, the safe-haven Japanese yen has been the weakest currency in the world, losing 2.5% against the dollar.

That’s precisely what Bank of Japan wants from its currency. A weaker Yen helps boost the exports and reduce imports, ultimately balancing the current account and trade balance deficit.

The Bank of Japan left its monetary stimulus steady and asked for an analysis of prices and the economy to discuss in its next meeting in October. The BOJ kept its interest rates and asset purchases at existing levels of -0.10%.

SNB – SNB Policy Rate – 7:30 GMT

The Swiss National Bank has the weakest interest rate in the world of -0.75%, and it has mediated in the foreign exchange market. However, still, the CHF (Swiss franc) continues to trade bullish around two-year highs against the Euro in early September.

The Swiss franc has enjoyed the bullish trend, gaining around 2.5% versus the Euro this year. Just like the BOJ, the SNB also feels relaxed in case of weaker CHF as it helps settle the current account and trade balance deficits.

Thus, the SNB is expected to keep the interest rates on hold at -0.75% vs. -0.75% previously.

BOE – Monetary Policy Decision – 11:00 GMT

At 11:00 GMT, the Official Bank Rate will be in highlights. The chances of a change in rate are almost 0%. BOE is widely expected to keep the rate on hold at 0.75%.

MPC Official Bank Votes – The BOE MPC meeting minutes include the interest rate vote for all MPC member during the most recent session. The division of votes presents an insight into which members are shifting their stance on interest rates and how alike the committee is to determine a rate change in the future.

Considering the sharp drop in the British inflation rate, the BOE may feel a need to accommodate the market. Therefore, it’s essential to see MPC voting today.

For the moment, the votings are 0-0-9, which means that all members are expected to vote to hold the rate. Nevertheless, in case you see any change in voting figures, it will be surprising enough to shake the market up to 100 pips.

Good luck, traders and stay tuned to FX Leaders Economic Calendar for live market updates.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account