Weekly Outlook, Sep 30-Oct 4: Top 5 Things to Watch This Week

Happy Sunday, traders.

I advise you get enough rest today, as the market is going to be on a rollercoaster ride in the week ahead. We got almost everything on the economic calendar – Chinese manufacturing, RBA Cash Rate, Canadian GDP, and most importantly, the US non-farm payroll figures.

Overall, the dollar remained stronger on Friday, staying around multi-week highs versus most major currencies as increased risks from political tensions to the Sino-US trade war boosted its safe-haven glow.

Key Economic Events This Week

The upcoming week brings a load of top tier fundamentals from all over the globe. Let’s get prepared for it.

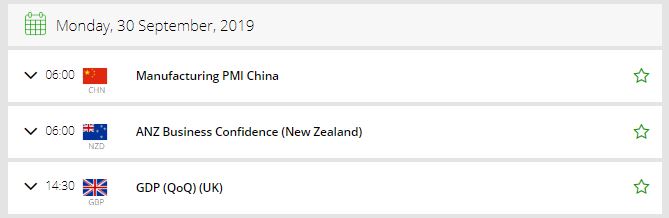

Monday – September 30

It’s not just another typical Monday as investors will be looking to trade the manufacturing and non-manufacturing PMI data from China. Besides, the Eurozone’s current account will be in focus. Asian trading volumes are anticipated to be light next week as Chinese markets will be closed from Tuesday onwards for National Day.

CNY – Caixin Manufacturing & Non-Manufacturing PMI – 1:45 GMT

Markit will be releasing the Chinese manufacturing & non-manufacturing PMI figures at 1:45 GMT. Those expecting a turnaround in China’s vast manufacturing division will presumably be disappointed as the official manufacturing PMI is projected to have lingered unchanged at 49.5 in September, pointing to continued mild reduction.

In contrast, the IHS Markit/Caixin PMI is anticipated to risen above the 50 level that divides expansion from contraction, but to have eased slightly to 50.2.

GBP – Current Account – 8:30 GMT

The Office for National Statistics is due to release the Current Account figures for the United Kingdom which exhibits a difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

Economists are expecting a squeeze in the trade deficit from -30.0B to -19.2B. Since it’s a quarterly figure, the impact is supposed to be a bit higher, but in this case, the goods portion does not effect because it’s a duplicate of the monthly Trade Balance data.

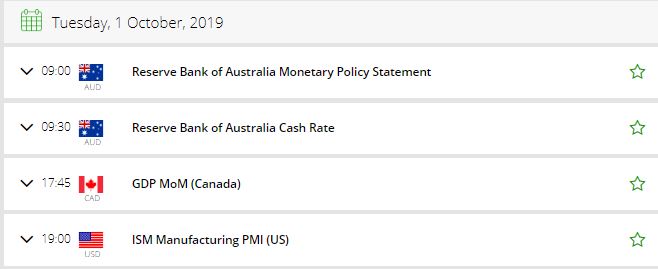

Tuesday – October 1

On Tuesday, we can expect some excellent opportunities in the Aussie denominated currency pairs, including the bullion market.

RBA Monetary Policy Decision – 4:30 GMT

It’s going to be one of the major economic events on Tuesday, as the RBA is anticipated to cut the interest rate by 25 base points, following the footsteps on the ECB and Federal Reserve.

The Reserve Bank of Australia’s governor, Philip Lowe, gave disturbing directions about the policy direction in statements made earlier this week.

Lowe left the market in astonishment when he said the Australian economy is at a “gentle turning point”. His surprising confidence proposed a rate cut at the subsequent meeting on Tuesday may not be a done deal. Nevertheless, he also intimated it was a preference to restrict the exchange rate from appreciating.

Therefore, investors still believe that the RBA will reduce rates in October for the third time. The rate cut already seems to have priced in around a 77% likelihood of a 25-basis point cut.

Wednesday – October 2

USD – ADP Non-Farm Employment Change – 12:15 GMT

This data provides an early look at employment growth, usually 2 days ahead of the government-released employment data that it’s designed to mimic. Source changed series calculation formula in February 2007, December 2008, and November 2012, to better align with government data.

The Automatic Data Processing, Inc. is expected to release a slight drop in data from 195K to 140K in the month of September. Job creation is an essential leading indicator of consumer spending, which accounts for a bulk of overall economic activity. Weaker data may drive bearish sentiments for the upcoming US NFP figures which are due on Friday.

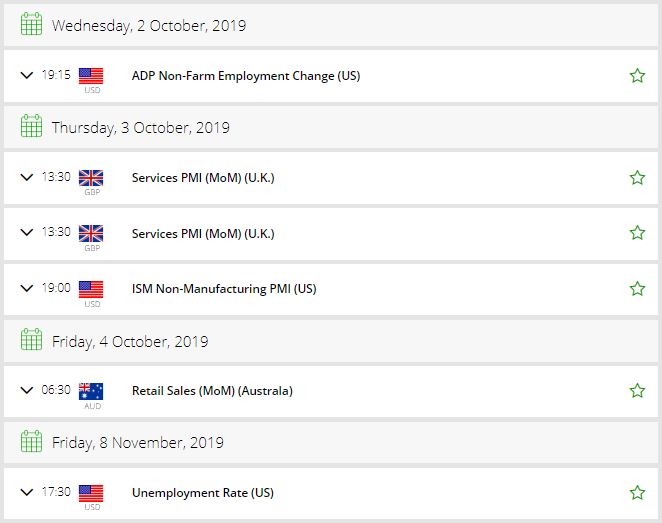

Thursday – October 3

ISM Non-Manufacturing PMI

Kicking off the week in the US will be the Chicago PMI for September on Monday. On Tuesday, the will be the ISM manufacturing PMI after the index sank below 50 in August for the first time in three years, abruptly elevating concerns of a downturn. There might be some respite, however, if the PMI recovers to 50.4 in September as forecast.

On Thursday, the ISM’s non-manufacturing PMI will be in focus, though predictions are for the composite index to drop slightly to 55.8 in September. Factory orders are also scheduled to release on Thursday before attention turns to the non-farm payrolls report on Friday.

Friday – October 4

USD – Labor Market Report – 12:30 GMT

The US NFP (Nonfarm Employment Change) and the unemployment rate will remain under the spotlight. Both these economic data sets will be monitored at 12:30 GMT. NFP is expected to be slightly positive at 140K vs. 130K during the previous month.

Whereas the unemployment rate is likely to stay unchanged at 3.7% and the Average Hourly Earnings are expected to rise by 0.2% vs. 0.2% previously. The weaker data will offer an opportunity to short the Greenback for a quick 60-100 pips and vice versa.

That’s all for now, but stay tuned to our economic calendar for the live market updates and forex trading signals.

Good luck!