WTI Crude Oil Turns Bearish After the Release of China’s Q3 GDP Figures

WTI crude oil is trading bearish early on Friday after the release of China's Q3 GDP, which has slowed to a weaker than expected rate of 6%

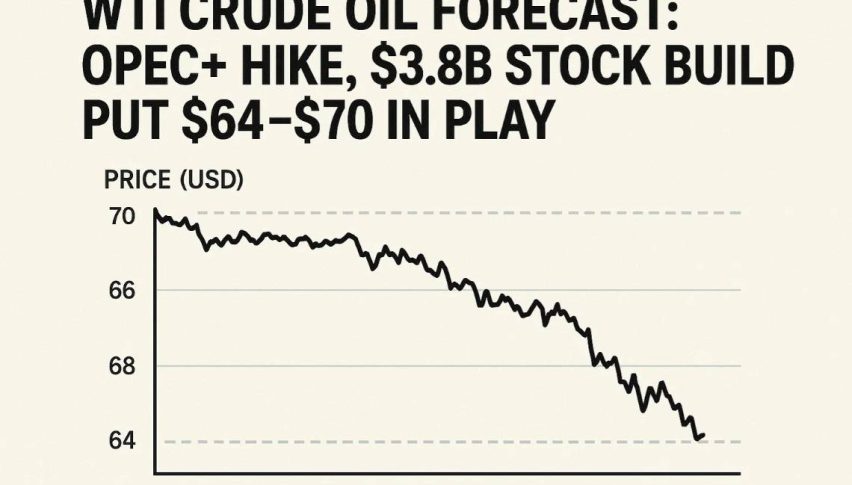

WTI crude oil is trading bearish early on Friday after the release of China’s Q3 GDP, which has slowed to a weaker than expected rate of 6.0% YoY. At the time of writing, WTI crude oil is trading around $53.79 per barrel.

The trade war has weighed heavily on China’s economy for more than a year, and it has started taking a toll on its economic growth. Economists were expecting Q3’s GDP to slide to 6.1%, which would still have been the slowest pace of growth since Q1 1992. Crude oil prices could weaken as China is the world’s biggest oil consumer, and any weakness in its economic growth could impact the demand for oil significantly.

WTI crude oil prices are also trading under pressure following the release of the EIA report on Thursday. The EIA report revealed a surge in US crude inventories by 9.3 million barrels during the previous week, far higher than the 2.8 million barrel build-up forecast. This data, coupled with recent economic data releases including US retail sales and now Chinese GDP figures, continue to focus on weakening oil demand globally.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account