AUD/USD Places Fresh High – Brace to Capture Correction

The AUD/USD currency pair hit the monthly high since 18 September, currently seen at 0.6860 due to the People’s Bank of China’s decision and China data.

People’s Bank of China (PBOC) changed the loan rate from 4.25% to 4.20%. The LPR is set based on the range above the medium-term Loan Facility rate every month. At the economic front, China’s September House Price Index fell to 8.4% from 8.8%.

Notably, Australian dollar’s strong buying reason could be positive trade headlines from China’s South Morning Post, whereas warning by the next European Central bank President Christine Lagarde looks to be ignored.

Risk-sentiment remains unchanged despite Brexit uncertainty and mixed trade headlines. As a result, the United States’ ten-years Treasury yields rose to 1.75%.

Besides, due to the lack of essential data and events on the economic calendar, from now, investors will keep their eyes on trade and Brexit news for fresh hints.

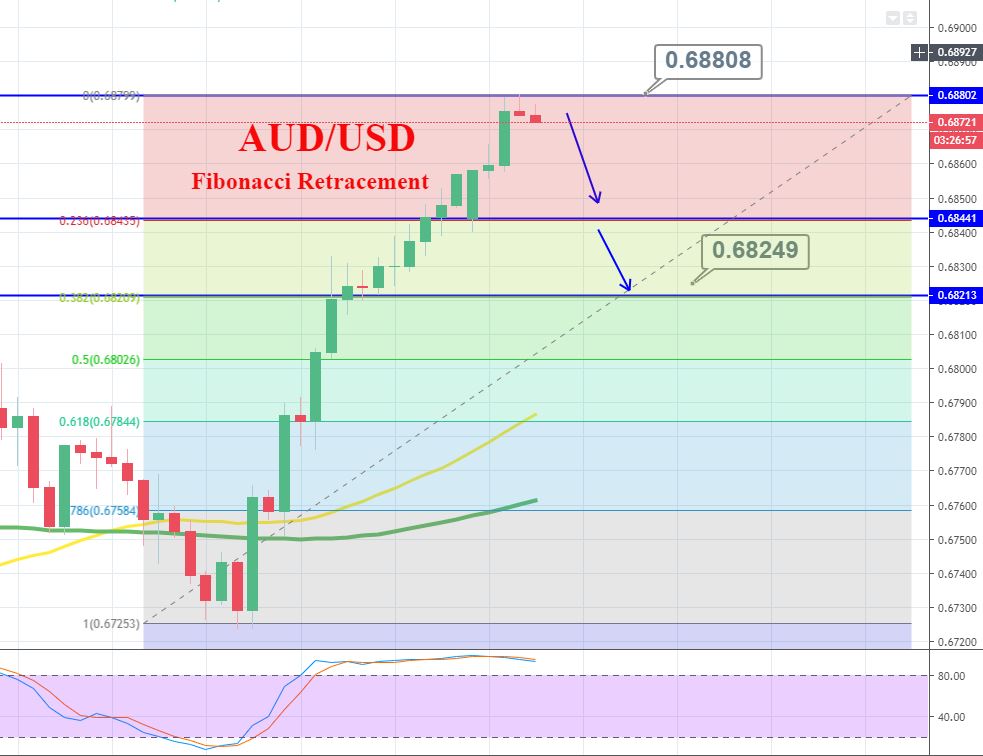

On the technical side, the daily closing above the 100-day level of 0.6852 becomes necessary for the pair to question September month high close to 0.6900, delining to which could move AUD/USD back to 0.6810 and 50-day EMA level of 0.6800.

Daily Support and Resistance

S3 0.6787

S2 0.6817

S1 0.6837

Pivot Point 0.6848

R1 0.6867

R2 0.6878

R3 0.6908

AUD/USD may trade bearish below 0.6880 with a stop loss of over 0.6900 and take profit around 0.6845 today.

Good luck!