Weekly Outlook, Oct 28-Nov 1: FOMC, GDP, CPI & NFP Under the Spotlight

This week is going to be action-packed in the United States, with preliminary GDP figures for Q3 tapping the markets on Wednesday...

Happy Sunday, traders.

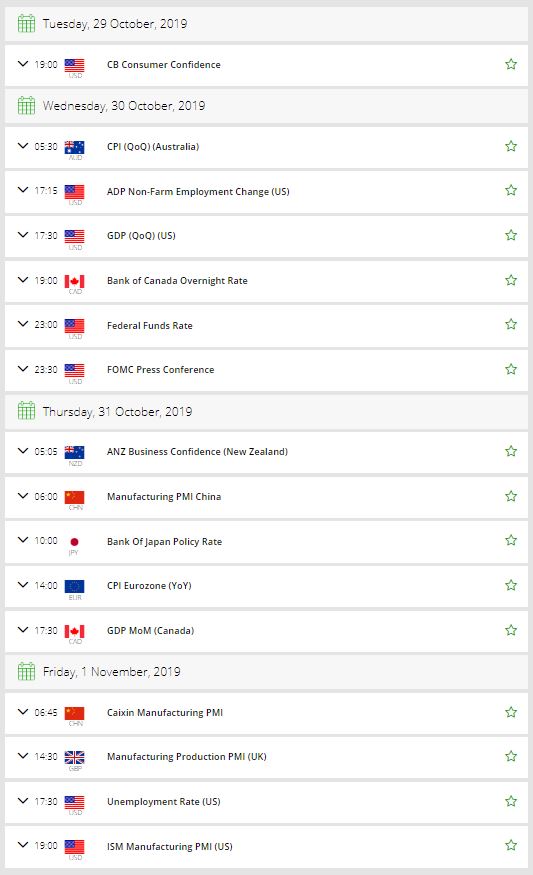

This week is going to be an action-packed one in the United States, with preliminary GDP figures for Q3 tapping the markets on Wednesday, a few moments before the Fed ends its meeting. Personal income and spending figures will follow on Thursday, alongside the core PCE price index for September, before the all-important nonfarm payrolls release for October are published on Friday. Last but not the least is the ISM manufacturing PMI which may attract the greatest attention given the difficulties encountered by the trade war.

Monday – October 28

MPC Member Tenreyro Speaks – 17:00 GMT

On Monday, the market is most likely to remain muted, but the Bank of England Member Silvana Tenreyro’s speech will remain in highlights. Tenreyro is due to speak about monetary policy and international macroeconomics at the John Flemming Memorial Lecture in London. Audience questions are expected, and any remarks on MPC policy expectations will be worth trading.

Tuesday – October 29

USD – CB Consumer Confidence – 14:00 GMT

Investors will monitor the CB Consumer Confidence. Fellows, this data will be of high importance on Tuesday as this usually causes excellent tradeable volatility in the market. It’s expected to be 128.2 vs. 125.1, giving us another reason for a bullish dollar.

Wednesday – October 30

EUR – German Prelim CPI – All Day

Destatis will be releasing German Prelim CPI figures, which accounts for a majority of overall inflation. Inflation is significant to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate. The German CPI has been crappy lately as the figure fell from 0.5% in July to -0.2% in September. The European Central Bank has made changes to its monetary policy in order to support the economy, and this month’s figure can be the first signal to understand whether the dovish policy has started working or not. Anyway, economists are expecting a 0% growth in the inflation rate.

USD – ADP Non-Farm Employment Change – 12:15 GMT

This data provides an early look at employment growth, usually 2 days ahead of the government-released employment data that it’s designed to mimic. Source changed series calculation formula in February 2007, December 2008, and November 2012 to better align with government data.

The Automatic Data Processing, Inc. is expected to release a slight drop in data from 135K to 125K in October. Job creation is an essential leading indicator of consumer spending, which accounts for a bulk of overall economic activity. Weaker data may drive bearish sentiments for the upcoming US NFP figures, which are due on Friday.

US Federal Reserve Monetary Policy Decision – 18:00 GMT

The Fed is widely anticipated to cut rates for a third consecutive time, with traders indicating a 90% possibility for such an action. Thus, the market response will depend mostly on the signals policymakers send regarding the possibility of planned action, not on the rate cut itself.

The Federal Reserve is broadly anticipated to present a 25 bp rate cut, the third this year. Beforehand, we thought the Fed would use this meeting to discuss the plumbing problems and the delivery of policy. Instead, it announced its T-bill purchases within meetings.

The dollar may trade bearish in the coming week as traders will be pricing in a rate cut from 2% to 1.75%.

Thursday – October 31

JPY – BOJ Monetary Policy Decision – Tentative

The Japanese yen reached almost a three-year high in late August, which had put the Bank of Japan in a tough position. Over the past three weeks, the safe-haven Japanese yen has been the weakest currency in the world, losing 2.5% against the dollar. That’s precisely what the Bank of Japan wants from its currency.

A weaker yen helps boosts exports and reduce imports, ultimately balancing the current account and trade balance deficit. Thus, the BOJ may keep its monetary policy unchanged on October 31.

Friday – November 01

USD – Labor Market Report – 12:30 GMT

The US NFP (Nonfarm Employment Change) and the unemployment rate will remain under the spotlight. Both these economic data sets will be monitored at 12:30 GMT. NFP is expected to be slightly positive at 90K vs. 136K during the previous month.

Whereas the unemployment rate is likely to advance from 3.5% to 3.6%, which may weigh on the US dollar.

Average hourly earnings are assumed to grow by 0.3% vs. 0.0% previously. The weaker data will offer an opportunity to short the Greenback for a quick 60-100 pips and vice versa.

ISM Manufacturing PMI – 14:00 GMT

On Friday, the ISM manufacturing PMI will remain in focus, especially after the index sank below 50 in September for the first time in three years, abruptly elevating concerns of a downturn. There might be some respite, however, if the PMI recovers to 49.0 in October as forecast.

That’s all for now, but stay tuned to our economic calendar for the live market updates and forex trading signals.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account