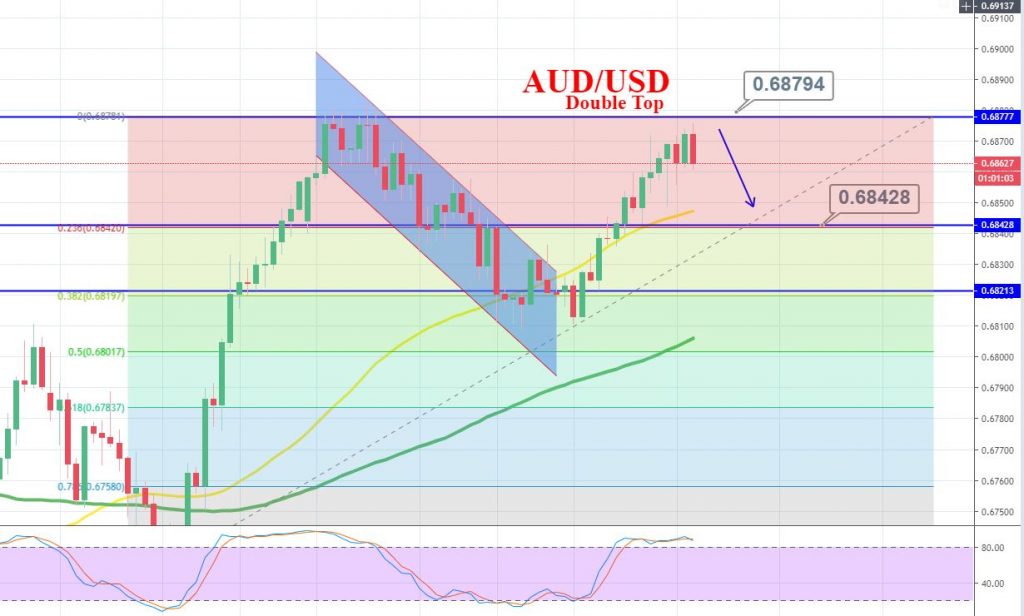

AUD/USD Heading Into the Double Top – is it Good Time to Short?

AUD/USD is trading below the double top level of 0.6880, the market may consider selling below this level until a bullish breakout occurs...

The AUD/USD currency pair hit the bullish track and increased by 16 pips mainly due to unexpectedly higher Australia’s 3rd-quarter inflation data release. Australia’s annualized consumer price index climbed slightly to 1.7% from 1.6% in three months to September. Quarterly, the inflation decreased slightly to 0.5% from the previous quarter’s 0.6%. The headline CPI was forecast to increase by 0.5% for the quarter and 1.7% over the year.

The bullish trend in the annualized inflation figure may force the markets to price out the possibilities of an additional rate cut by the Reserve Bank of Australia RBA in November. Before the inflation data statement, the assumed probability of the rate cut by the 25-basis-points to the cash rate in November was at just 14%.

Therefore, the Australian Dollar may continue trading in bullish trends during the day ahead. As of writing, the AUD/USD currency pair is currently trading at 0.6865, as the pair recovered by 16 pips from the low of 0.6849 after the release of the Australian CPI data.

Daily Support and Resistance

S3 0.68

S2 0.683

S1 0.6846

Pivot Point 0.6859

R1 0.6875

R2 0.6888

R3 0.6918

Since AUD/USD is trading below the double top level of 0.6880, the market may consider selling below this level until a bullish breakout occurs. On the lower side, the target is likely to be 0.6840.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account