Daily Brief, Nov 21: Economic Events Outlook – ECB Policy Minutes Ready for Action

The dollar traded bullish on Wednesday as worsening US-China relationship stoked appetite for the greenback ere the announcement of minutes from the Federal Reserve’s October policy meeting where it cut interest rates for the third time this year. Therefore, the risk currencies declined, and the Japanese yen, the safe-haven currency, gained after US President Donald Trump warned about a trade war escalation.

The Chinese Foreign Ministry spokesman, Geng Shuang, warned the Trump administration that they should take steps to stop the bill from becoming a law. He added that they should stop meddling in the internal affairs of China and Hong Kong to avoid setting a fire that would only burn themselves.

The news of passing this bill right after the increased trade tensions due to conflict of interest of both parties on tariffs removal gave a boost to the safe-haven appeal, and as a result, Gold recovered some losses it suffered on Wednesday.

Lastly, the Fed meeting minutes revealed that Fed officials were more optimistic about the economic condition of the United States and were against using negative rates in the next recession.

Watchlist – Key Economic Events This Week

GBP – Public Sector Net Borrowing – 9:30 GMT

The Office for National Statistics is due to release Public Sector Net Borrowing, which indicates the difference in value between spending and income for public corporations, the central government, and local governments during the previous month.

A positive number indicates a budget deficit; a negative number indicates a surplus. This figure includes “financial interventions” – there is also a figure released at the same time, which excludes them.

Economists are expecting a slight drop in net borrowing figures from 8.7B to 8.5B, which is considered suitable for British Pound as less money will be in circulation, and less supply of money makes the exchange rate better.

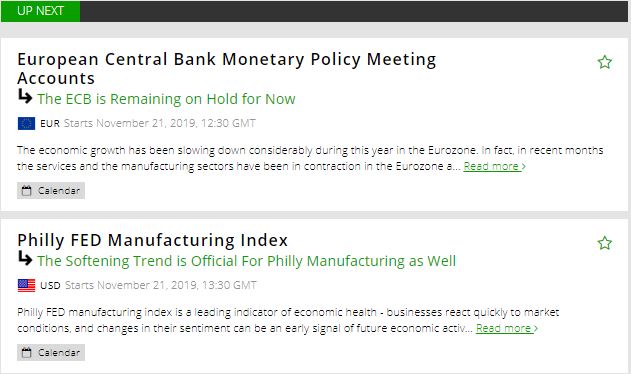

EUR – ECB Monetary Policy Meeting Accounts – 9:30 GMT

The European Central Bank is the main highlight of the day as it’s due to release the policy minutes from its previous press conference.

The last meeting led by Mario Draghi as President of the European Central Bank was solely focused on preserving his legacy and particularly discussing the last policy changes in November. The Frankfurt-based institution decreased rates and declared resumption of the bond-buying program.

Today, the ECB meeting minutes may repeat the same sentiment along with welcoming the new president – Christine Lagarde. The euro is set to move, but the direction will be clear once policy minutes are out.

USD – Philly Fed Manufacturing Index – 13:30 GMT

The Federal Reserve Bank of Philadelphia is due to the release of the Manufacturing Index. It’s a leading indicator of economic health – businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

The figure is expected to surge to 7 vs. 5.6 in the previous month. The dollar may gain some support on the release of the news.

Good luck for today, and stay tuned for more updates!