Daily Brief, Dec 11: Economic Events Outlook – Big Day, Fed Monetary Policy in Headlines

The market is likely to exhibit sharp movements in the wake of Fed rate decisions and the U.S. inflation rates today. The chances of the...

Good morning, traders.

The market is likely to exhibit sharp movements in the wake of Fed rate decisions and the US inflation rates today. The chances of the fourth rate cut by Federal Reserve in its meeting on Wednesday have declined after better than expected labor market figures and ongoing trade developments between US & China.

These two factors were heavily weighing on the decision of Fed for further rate cuts, but after the raised optimism in the market related to these issues, it has now become certain that Fed would not cut its rates today. Let’s take a more in-depth look at the economic calendar.

Watchlist- Economic Event Outlook

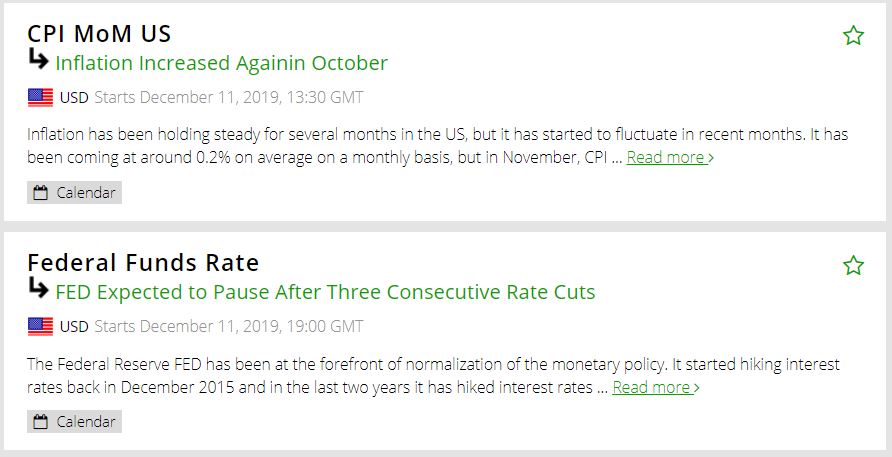

CPI m/m – 13:30 GMT

For all the newbies, the Core Consumer Price Index (CPI) covers the changes in the price of goods and services, excluding food and energy. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Lately, the US Federal Reserve Chairman Jerome Powell emphasized that recent weakness in inflation has been temporary — and the surge of core CPI to 2.1% in October supports his words.

However, the inflation figures for December may pose additional hurdles for the Federal Reserve. Headline CPI increased by 0.4% m/m in November and Core CPI by0.2% while a rise of 0.2% in CPI and 0.2% in Core CPI is on the cards today.

US Federal Reserve Monetary Policy Decision – 19:00 GMT

The Fed is widely anticipated to keep the unchanged policy rates this time, with traders indicating a 90% possibility for no change sentiment. Thus, the market response will depend mostly on the signals policymakers send regarding the possibility of planned action, and not on the rate decision itself.

The Federal Reserve is broadly anticipated to keep the present rate of 1.75% unchanged. Previously, we thought the Fed would use this meeting to discuss the plumbing problems and the delivery of policy. Instead, it announced its T-bill purchases within sessions, and it has already cut interest rates three times in a row.

Hence, the US dollar index is likely to stay supported today, while weighing on gold.

That’s all for now, but stay tuned to our economic calendar for live market updates and forex trading signals.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account