WTI Crude Oil Stays on Track for Highest Gains Since 2016

The WTI crude oil prices flashing red but still trading with the biggest annual gain since 2016. As well as a rebound forecast in U.S...

WTI crude oil prices are flashing red but still trading with the biggest annual gain since 2016. In addition, a rebound forecast in US shale crude production will likely happen.

New York-traded West Texas Intermediate, the US crude benchmark, settled down 62 cents, or 1.0%, at $61.06 per barrel. Even after that drop, WTI rose 11% for December, its largest monthly gain since January.

On an annual basis, WTI rose 34% – the most significant annual gains since 2016 for crude oil.

We can attribute the crude oil prices’ 2019 rally with production cuts by OPEC. Since January, the Saudi-led OPEC, joined by Russia under the OPEC+ alliance, has tried to observe a daily production cut of 1.2 million barrels.

Whereas the US crude production overall hit a record high of 12.9 million barrels per day in 2019, shale oil output, which accounts for more than half of US total production, has been moderately restrained this year.

Non-OPEC oil supply, led by US shale, is expected to increase by 2.1 million barrels a day in 2020, news came from the Paris-based International Energy Agency (IEA). Global demand for oil is set to increase by 1.2 million barrels a day next year, according to the EIA report.

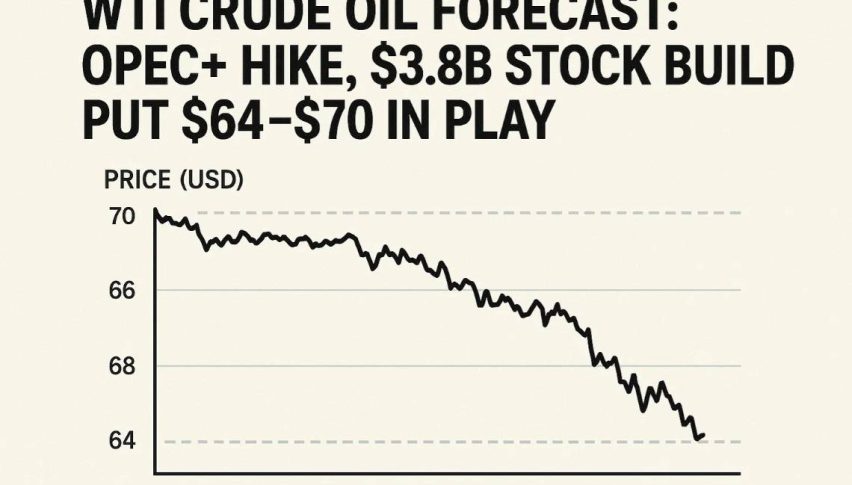

As we recently mentioned, the WTI crude oil prices rose by roughly 36% since 2016, mainly due to the easing uncertainty between the United States and China trade talks as well as output cuts pledged by the Organization of Petroleum Exporting Countries (OPEC) and its allies.

Looking forward, this year will likely start with positive news about the phase-one trade deal between the United States and China, because as we know, President Donald Trump tweeted on Tuesday that they will sign the agreement on January 15. But despite that, the trade deal’s positive impact could come undone if the US gross output rises sharply.

Daily Support and Resistance

S3 58.69

S2 59.9

S1 60.49

Pivot Point 61.12

R1 61.71

R2 62.34

R3 63.56

Since the market is closed today in the wake of the new year holiday, we wish you a very successful year ahead. Enjoy your time!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account