Daily Brief, Jan 31: Economic Events Outlook – Canadian GDP in Highlights

Happy Friday, fellas.

The global financial markets continue to trade with mixed sentiments in the wake of stronger GDP and safe-haven appeal triggered by a coronavirus. The demand for the dollar index soared, and the safe-haven Japanese yen firmed moderately in the wake of risk-off tone, in the wake of uncertainty about the economic slowdown due to the coronavirus outbreak.

Although markets had calmed somewhat overnight and appetite for risk assets returned, weakening the yen and Swiss franc, continued uncertainty about the impact of the virus on China, and the knock-on effects globally have kept investors wary.

Potential Economic Events to Impact

EUR – Spanish Flash GDP q/q – 8:00 GMT

The National Statistics Institute is releasing Spanish Flash GDP figures at 08:00 GMT. Overall there are two variants of GDP published about 20 days apart – Flash and Final. The Flash announcement is the earliest and thus tends to have the most impact. The Final is not reported for lack of significance.

Since this one is Flash, investors will be closely watching it for a quick trade in EUR/USD. Economists are expecting a 0.4% growth rate in Spain, which is neither better nor worse than the previous month’s data. We may not see any significant movement on its release.

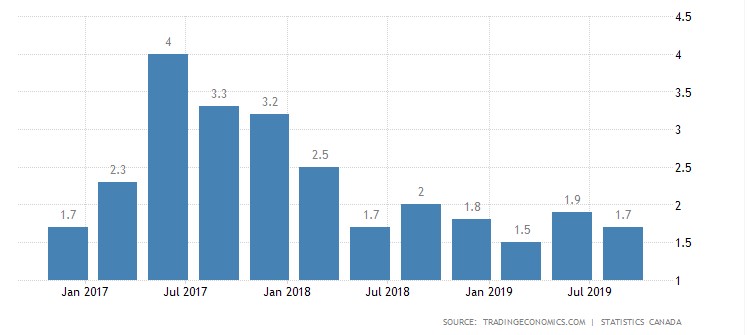

CAD – GDP m/m – 13:30 GMT

Statistics Canada will be releasing the GDP figures for the Canadian economy at 13:30 GMT. The Gross Domestic Product GDP in Canada was worth 1709.30 billion US dollars in 2018. The GDP worth of Canada represents 2.76% of the world economy.

GDP in Canada averaged 652.54 USD Billion from 1960 until 2018, reaching an all-time high of 1842.02 USD billion in 2013 and a record low of 40.77 USD billion in 1961.

Economists are expecting a rise in Canadian GDP figures from -0.1% to 0.0%. The Loonie may trade with a slight bullish bias today.

USD – Chicago PMI – 14:45 GMT

The ISM-Chicago, Inc is due to release Chicago PMI figures at 14:45 GMT with a neutral forecast of 48.9 vs. 48.9. Newbies, this is a survey of around 200 purchasing managers in Chicago which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

The negative forecast may keep the US dollar in check, while positive data may bring further buying in the buck.

That’s it for today, but do check FXLeaders economic calendar for the live coverage of these major events.

Good luck!