US Dollar Trades Close to Two-Month Highs as Markets Expect More Fed Rate Cuts

The US dollar is trading weak, close to the lowest level in two months, as fears of the economic fallout of the coronavirus continue to

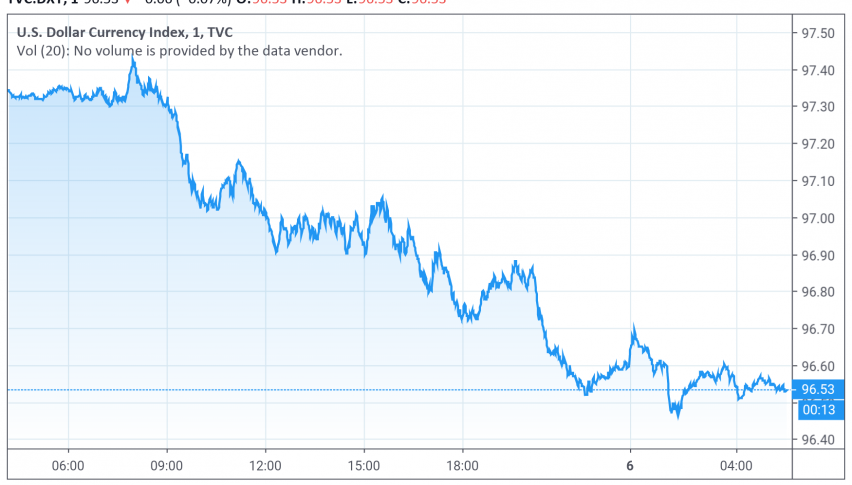

The US dollar is trading weak, close to the lowest level in two months, as fears of the economic fallout of the coronavirus continue to dominate the market sentiment and support expectations for additional rate cuts by the Fed in the near future. At the time of writing, the US dollar index is trading at around 96.53.

The 10-year Treasury yields fell to record lows in the previous session over mounting worries about the possible impact of the coronavirus on the US as well as global economies, despite the Fed cutting interest rates by 50bp earlier this week. Markets are now betting on more rate cuts, up to as much as an additional 0.50% coming as soon as later this month, as the number of cases and death toll continue to grow around the world, threatening to send the global economy into recession.

Other currencies are also trading weak as markets expect other leading central banks to also turn dovish, however, the euro and the Japanese yen are trading strong against the US dollar as the ECB and BOJ have limited room for further easing with rates already in the negative territory. This sentiment is lending support to these respective currencies for now, although the markets are trading with a risk-off sentiment.

Against commodity currencies and Asian currencies, however, the US dollar continues to maintain its strength as a safe haven currency, lending it some support.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account