Daily Brief, Mar 10: Risk-off Sentiment Continues to Play, How to Trade Gold?

The economic calendar remains a bit lite as we lack major economic events from the world's big economies. The GDP figures from Eurozone...

Good morning, fellas.

The economic calendar remains a bit light as we lack major economic events from the world’s leading nations. The GDP figures from Eurozone may have a slight influence on the market, but overall, most of the market may price in coronavirus fears and technical levels.

Today in the early Asian session, the safe haven metal prices failed to continue its multi-year high bullish trend and dropped to $1,671 level after knowing that the global policymakers sets actions plan to control coronavirus (COVID-19). As of writing, gold is currently trading at 1,665.31 and consolidates in the range between the 1,662.08 – 1,680.41. As we already mentioned, the safe haven metal recently took some directions from the US Coronavirus Task Force instructions that showed the US policymaker’s willingness to take actions as well as the availability of sources.

It should be noted that the US President Donald Trump said we would take significant economic actions in the wake of coronavirus. Whereas, Vice President Mike Pence took U-turn from his Friday’s comments and signaling a lack of enough testing kits in the labs. Moreover, the US Treasury Secretary Steve Mnuchin mentioned his regular discussions with the Fed Chair Jerome Powell about the willingness to work with small businesses that need liquidity.

Apart from this, the risk recovery could be attributed to the latest numbers from China that show a continued reduction in the cases and death toll. As a result, the US equity futures bounced off the previous day’s seller circuit levels to 1.8%, 2,795, whereas the US 10-year treasury yields recover from the record low to 0.64% by the press time.

Looking forward, investors will now keep their eyes on US President Donald Trump’s press conference, no time specified as of now, to measure the world’s largest economy’s response to the deadly virus.

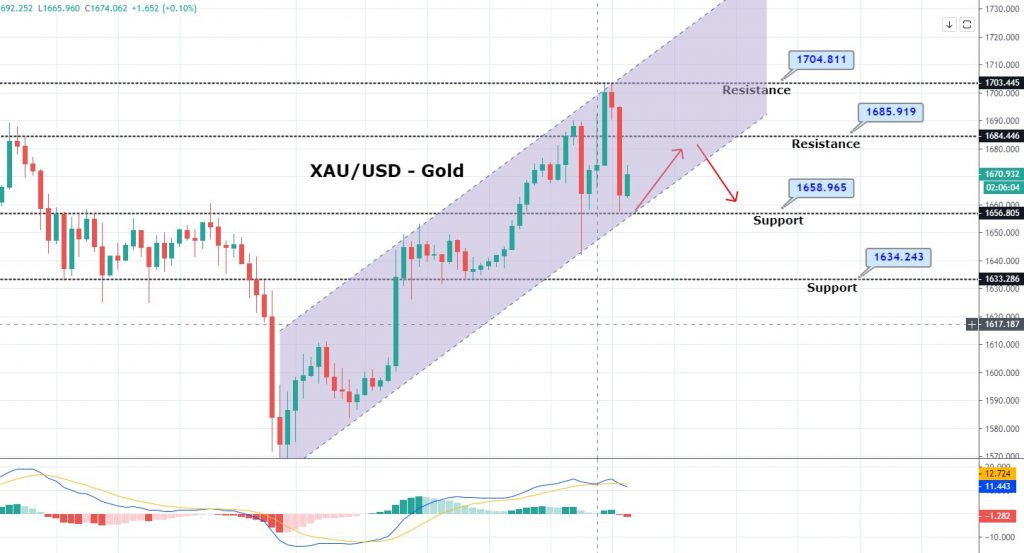

Daily Support and Resistance

S1 1617.9

S2 1646.28

S3 1663.38

Pivot Point 1674.65

R1 1691.76

R2 1703.03

R3 1731.4

GOLD prices are trading with a bearish bias around 1,655 level as the yellow metal has violated the bullish channel which supported the pair around 1,665.

Technically it should drive sharp selling in gold but the weekly pivot point level may support the precious metal around 1,647. Gold has recently crossed below 50 EMA level and it’s likely to extend selling until 1,647. In case it breaks below 1,647, the next support can be seen around 1,633.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account