Forex Signals Brief for Mar 11: Markets Show Some Respite – For Now

It’s been a wild ride on financial markets over the last week and despite a bounce yesterday, there remains an underlying sense of fear and

US Market Wrap

It’s been a wild ride on financial markets over the last week and despite a bounce yesterday, there remains an underlying sense of fear and worry across the board.

After a record fall on US equity markets, the SPX and Dow both responded with strong positive sessions. However, volatility was high and price swung around wildly all day long.

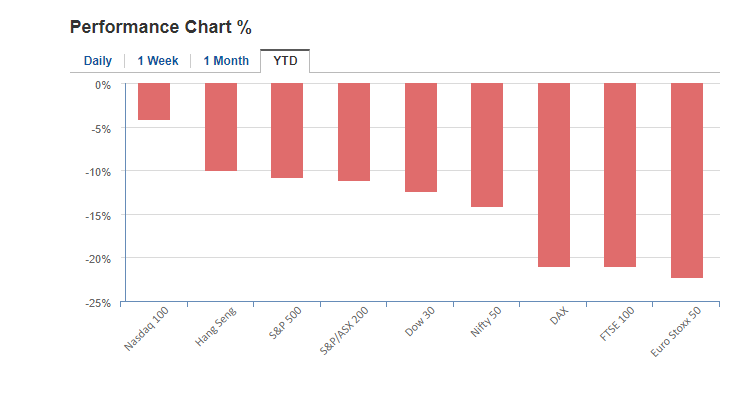

And while the focus has been on what has happened on Wall Street is it easy to miss some of the big selling happening in Europe. As we can see by this quick snapshot, Europe is feeling the brunt, particularly as cases of coronavirus jump above 10,000 in Italy and with the whole country in lockdown there might be more falls ahead.

Today’s Agenda

This morning it appears the sellers are back in control and the green day we saw yesterday will likely be short-lived.

There is a bit of data out today, especially in the UK, however, as has been the case, it is sentiment that remains the story of every session at the moment. The GBP/USD will focus on GDP and Manufacturing Production, however, both numbers will be lagging any real fallout from the coronavirus.

In the US, CPI is due for release as well but we shouldn’t expect to see a dent in that number just yet. The US is still in the early stages with the virus and that makes things a bit more unclear if anything. However, we did see a fall in energy prices hit inflation last month.

Later in the day, we’ll get WTI inventories but after the recent moves from both OPEC and the panic selling, I would suggest this won’t have the weight it usually does.

Forex Signal Update

The FX Leaders Team finished with three straight winning signals in what is shaping up as another solid week.

WTI – Pending Signal

WTI has arguably been the most volatile and hard-hit of all financial products over the course of the week. We’ve seen the buyers stepping up at $30 as these are GFC-type levels. However, we will look for a little sell-off in the short-term.

SPX – Watching

The SPX bounced back hard yesterday, up 5% on the session. Again this is one to keep watching given the unprecedented volatility.

Cryptocurrency Update

BTC tried and failed at the $8,000 level despite poking its head above that point.

We are now entering a little consolidation phase and a break of either the highs or lows here would be a good signal for a push in either direction.

Clearly, the bears are in control, but this is a chance for a short-term momentum move in either direction, given how far price has moved in the last few sessions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account