US Dollar Back in Favor as Safe Haven Currency Amid Raised Fears of Coronavirus Impact

The US dollar is back in the spotlight and finds favor once again among investors over the worsening market sentiment driven by rising fears

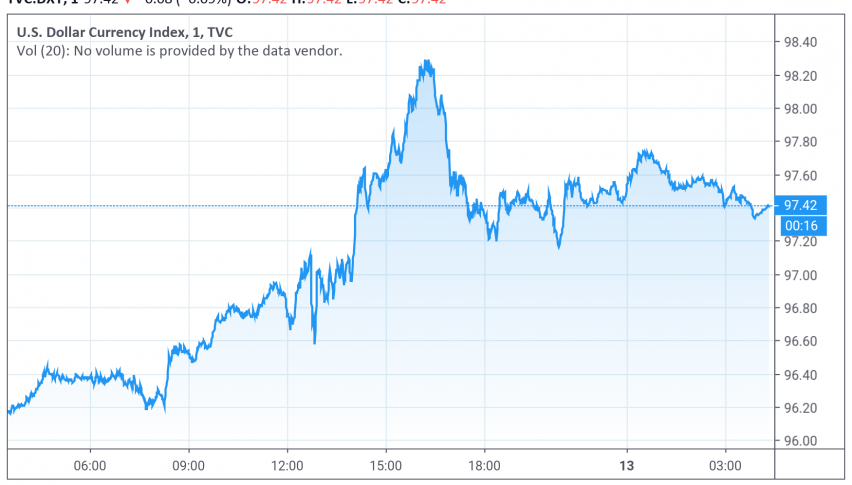

The US dollar is back in the spotlight and finds favor once again among investors over the worsening market sentiment driven by rising fears of the potential economic impact of the coronavirus pandemic. At the time of writing, the US dollar index DXY is trading at around 97.42.

The safe haven appeal of the US dollar remains in focus and traders make a beeline towards the most liquid currency globally in times of crisis and uncertainty, even as its peers perform poorly after several governments and central banks unveiled stimulus measures to prop up their economies. The Euro weakened in the previous session after the ECB’s response to the coronavirus outbreak disappointed markets when it chose to hold rates steady but roll out a stimulus package for banks instead.

Meanwhile, the Fed unleashed $1.5 trillion worth of short-term liquidity even as markets await further easing in monetary policy by the US central bank amid escalating worries about the outbreak impacting the economy. After a few days of weakness, the risk-off sentiment is lending support to the US dollar once again for now.

The next monetary policy meeting of the Fed is scheduled to take place next week and expectations are high that the central bank could cut rates once again, possibly bringing them all the way down to zero as well.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account