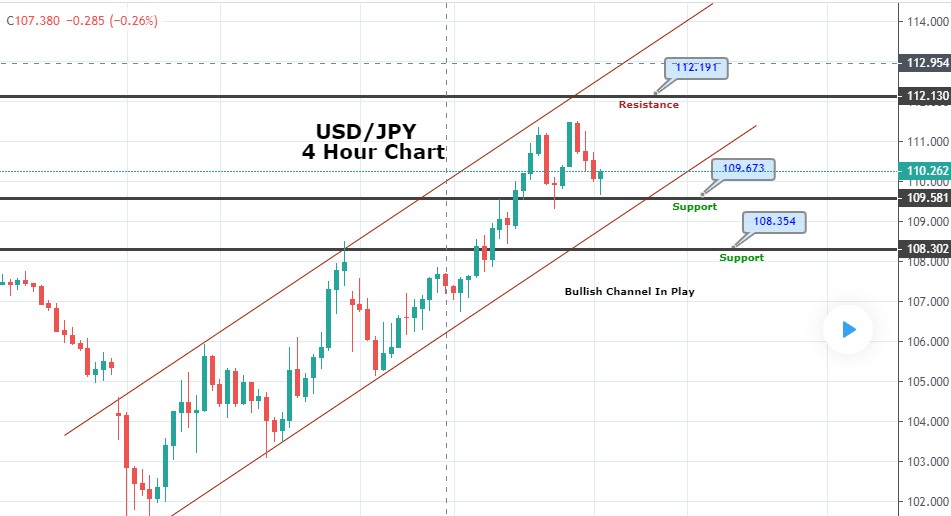

USD/JPY’s Bullish Channel Supports – Who’s Up for a Bullish Trade?

The USD/JPY gained 0.1% to 111.89 on Monday morning before falling to the intraday support level of 109.750. The demand for safe-haven asset

USD/JPY gained 0.1% to 111.89 on Monday morning before falling to the intraday support level of 109.750. The demand for the safe haven Japanese yen remains a bit high in the wake of weaker US fundamentals and an increased number of cases in the US. As a result, the traders are heading into the actual safe-haven assets like gold and Japanese yen while taking their money out of the US dollar.

Besides, the US stock futures are back up, but still down more than 4% while the US 10-year treasury yields drop 13 basis points (bps) to 0.805% by press time. Looking ahead, the US COVID-19 Bill headlines will be the key to watch. Japan’s reaction to the latest coronavirus updates will also be important to watch. However, investors will now keep their eyes on further global measures to control the pandemic for immediate direction.

Daily Support and Resistance

S1 106.2

S2 108.38

S3 109.59

Pivot Point 110.55

R1 111.77

R2 112.72

R3 114.9

On the technical side, Friday’s high near 111.50 holds the key to the pair’s fresh run-up towards the February month top surrounding 112.20. Unless breaking the same, the quote is likely to decline towards 109.00, comprising 100-day and 50-day SMA confluence. Looking at the 4-hour chart, the USD/JPY pair has formed a bullish channel that is supporting it around 109.650.

A bearish breach of this level can trigger selling until 109.125. Alternatively, the chances of a bullish trend remain high above 109.500 with a target at 111 and 111.23. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account