COVID-19 Affects Gold Pricing – Spread Soars to Highest

The safe haven metal prices are flashing green and continue to gain traction towards the $1,700 mark mainly because the United States stimulus package seems close to getting passed. The broad-based US dollar weakness also gave a boost to GOLD prices earlier. At the time of writing, gold is at 1,663.80 and consolidates in the range between 1,656.55 and 1,699.15. The recovery in the market risk sentiment and the US dollar weakness seem to have favored the bullion off-late.

Gold futures rose 0.66% to $1,671.75 after a 6% jump during the previous session. Contributing to the yellow metal’s best day in over a decade was a US Senate announcement that a deal for a massive stimulus package to control the COVID-19 economic recession fears was close. The increased probabilities of the expected $2 trillion package to control the deadly virus’s economic impact and an initial pattern of depleting coronavirus (COVID-19) cases from Italy also boosted the market risk sentiment. Meanwhile, the reason behind the risk-on sentiment could also be the global efforts, triggered by the Fed, to control the negative implications of the disease.

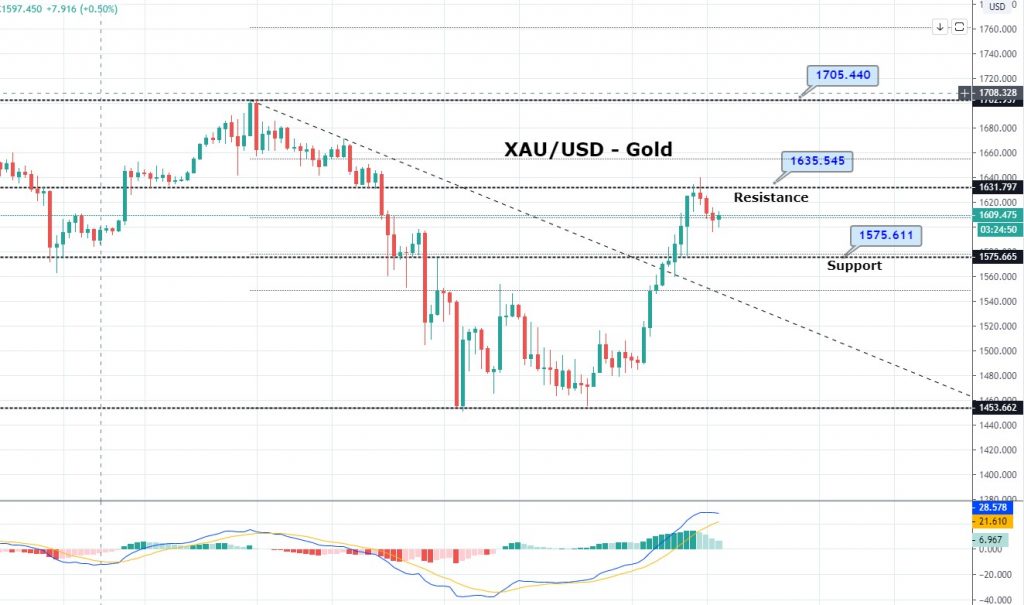

Daily Support and Resistance

S1 1449.52

S2 1529.76

S3 1581.49

Pivot Point 1609.99

R1 1661.73

R2 1690.23

R3 1770.46

Gold is one of the least favorite securities to trade due to a massive surge in its spread,. In fact, a few forex trading brokers have stopped its trading due to massive volatility in the market. Anyways, the precious metal is facing immediate support around 1,603, which is a crucial trading level today.

A bearish breakout of this level can extend selling until 1,588 and 1,579. Whereas, a continuation of a bullish trend above 1,603 level can drive buying until 1,635. The overall sentiment is pretty mixed, but bullish bias may prevail considering the raised safe haven appeal in the market. Good luck!