Gold’s Bullish Bias Dominates Amid Increased COVID-19 & Weaker Dollar

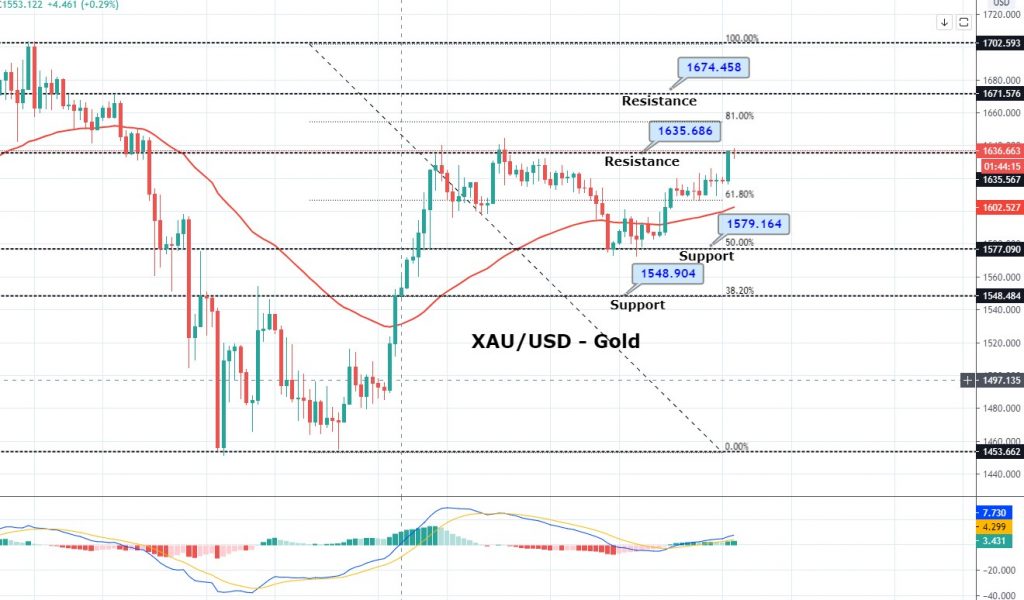

Gold continues to trade in a tight trading range of 1,620 - 1,608, where an overall trading bias remains bullish. As we can see on the...

The safe haven metal prices were flashing green and rose to 1,660 level, but the gains are limited in GOLD because traders are still cautious about the continuing economic turmoil. In short, traders are in a “Wait and See Mode” because they want more clarity and more news. The yellow metal prices are currently trading at 1,659.90 and consolidating in the range between 1,638.30 and 1,660.65.

On the positive side, the headline recently gave support to the gold prices that the three Swiss refineries in Ticino, Europe’s biggest gold refiner, announced yesterday that they got permission to open their factories on a limited basis. This statement will ease the supply concerns which are caused by the coronavirus lockdowns and transport stops.

On the other hand, the US Bureau of Labor Statistics announced a 701,000 reduction in non-farm payrolls, against the expectations of a 100,000-loss.

Daily Support and Resistance

S1 1576.16

S2 1596.66

S3 1607.74

Pivot Point 1617.15

R1 1628.24

R2 1637.65

R3 1658.14

Gold continues to trade in a tight trading range of 1,620 – 1,608, where an overall trading bias remains bullish. As we can see on the 4-hour chart, gold has immediate resistance at 1,619, which is extended by the double top and descending trendline pattern.

Worse than expected, US NFP figures are likely to trigger a bullish breakout and lead gold prices towards the next target level of 1,633 and 1,642. Alternatively, a bearish breakout can lead to gold prices lower to 1,594 areas. The bullish bias remains strong. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account