Daily Brief, Apr 17: Dramatic Plunge in Gold – Things You Need to Know on Friday

Gold prices exhibited a dramatic bearish trend, falling from 1,717 level to 1,696 level, and most of the selling was triggered following a ..

Happy Friday, fellas.

The economic calendar is offering low impact economic events from the Eurozone, which may not drive any significant movement in the market today. However, it’s worth watching the final CPI figures from the Eurozone today.

Today in the early Asian session, the safe haven metal prices were flashing red and dropped to $1,703 level, representing 0.38% losses on the day mainly due to the global stocks flashing positive after the United States President Donald Trump’s plans to reopen the world’s biggest economy after a month-long lockdown to prevent the spread of COVID-19.

The renewed hopes for coronavirus treatment also supported the risk-on market sentiment and weakened the safe haven demand in the market. At the time of writing, GOLD is currently trading at 1,720.50 and consolidating in the range between 1,703.40 and 1,736.25.

Gold futures were down by 0.38% at $1,725.2 retreating from their gains in the previous session. Gold gained 1.3% because the US also announced that 5.2 million people claimed unemployment benefits over the past week, against expectations of 5.1 million.

On the other hand, the United States President Donald Trump’s steps for reopening the economy could add some further bullish pressure around the equities. China reported a bigger-than-expected 6.8% decrease in the gross domestic product for the first quarter during the Asian trading hours.

As a result, the market’s risk-tone remains upbeat and supports the 10-year US Treasury yields to improve further and to erase the previous day’s losses, currently near 0.67%.

Looking forward, the market sentiment is expected to stay positive during the day ahead. As a result, the safe haven metal could continue losing its bullish attitude. At the data front, CB Leading Index m/m is scheduled to release, while the US data calendar is thin with just Baker Hughes US Oil Rig Count number is expected to release at 17:00 GMT.

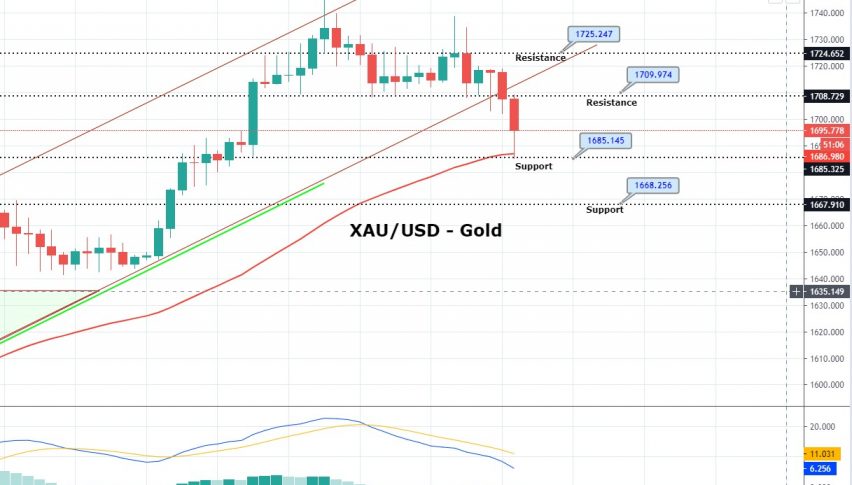

Daily Support and Resistance

S1 1657.71

S2 1689.78

S3 1703.73

Pivot Point 1721.85

R1 1735.8

R2 1753.92

R3 1785.99

Gold prices exhibited dramatic bearish trend, falling from 1,717 level to 1,696 level, and most of the selling was triggered following a less than expected US jobless claims data, which triggered optimization around the US economy. Gold may find an immediate resistance around 1,685 and 1,688 level, while resistance stays around 1,709 level today. Let’s consider staying bearish below 1,700 level today.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account