WTI Crude Oil Under Pressure – US-China in Highlights Again

Crude oil is on a bearish run, trading at 32 levels, holding right above an immediate support level of 31.40 level. Closing of candles...

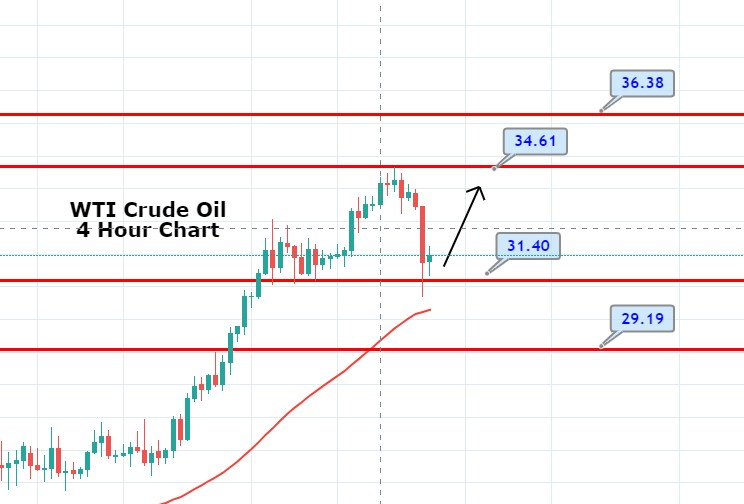

During Thursday’s Asian trading hours, WTI crude oil prices flashed red and dropped around $31.77 after taking a U-turn from $32.50 mainly due to increased tensions between the US and China. Additionally, coronavirus (COVID-19) concerns also weighed on oil prices. Moreover, the reason for the decline of crude oil prices could also be attributed to the downbeat weekly inventory data from the American Petroleum Institute (API). On the other hand, the reports that Russia wanted to start easing production cuts in July, as planned under the OPEC+ output cut deal agreed in April, also exerted some bearish pressure on crude oil prices.

Currently, crude oil prices are currently trading at 31.70 and consolidating in the range between $31.16 and $32.38. US West Texas Intermediate (WTI) crude futures edged lower 4.4% or $1.44 at $31.37 a barrel at 04:02 GMT after slipping as much as 5% to a low of $31.14 earlier in the session.

At the data front, the API figures for the week ended on May 22 showed that the US weekly crude oil stockpiles rose by 8.731 million barrels against the previous draw of 4.8 million barrels.

Daily Support and Resistance

S1 27.96

S2 30.43

S3 31.39

Pivot Point 32.89

R1 33.85

R2 35.35

R3 37.82

Crude oil is on a bearish run, trading at 32 level, holding right above an immediate support level of 31.40 level. Closing of candles above 50 EMA is suggesting the chances of a bullish trend in crude oil. On the higher side, oil may find resistance around 34.40 level and bullish crossover of this may drive further buying until the next target level of 36.30. Let’s look for buying trades over 32 and selling below this. All the best!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account