WTI Crude Oil Reporting Losses – Trading Range Remains Intact

WTI crude oil prices flashed red and extended losses from $34.34 to $33.56 mainly due to the fears of the US-China tussle. On the other hand, investors failed to cheer the broad-based US dollar weakness due to the cautious market sentiment ahead of an announcement by President Donald Trump on China later today. At this moment, WTI crude oil is currently trading at 32.68 and consolidating in the range between 32.66 and 33.77.

However, crude oil’s initial gains could be associated with the increasing hopes of the global economic restart and the coronavirus (COVID-19) vaccine optimism. It should be noted that the WTI futures increased 2.7% during the previous session due to optimism about the global demand recovery as countries emerged from COVID-19 lockdowns.

The reason for the risk-off market sentiment could be attributed to US President Donald Trump’s conference about China’s further sanctions, which is scheduled to happen at 18:00 GMT today. Whereas, the risk-off mark mood was further bolstered by the report that the House of Representatives has passed a bill to levy sanctions on the diplomats from Beijing involved in the Xinjiang case, which eventually kept the energy benchmark market under pressure.

Moving on, declines in the crude oil prices could be long-term as the possible US actions could include trade sanctions, which will likely influence the demand of oil that has been slowly recovering from the lockdowns. On the other hand, the reason for the reduced demand could also be attributed to the second-wave outbreaks, with the number of global COVID-19 cases approaching 6 million.

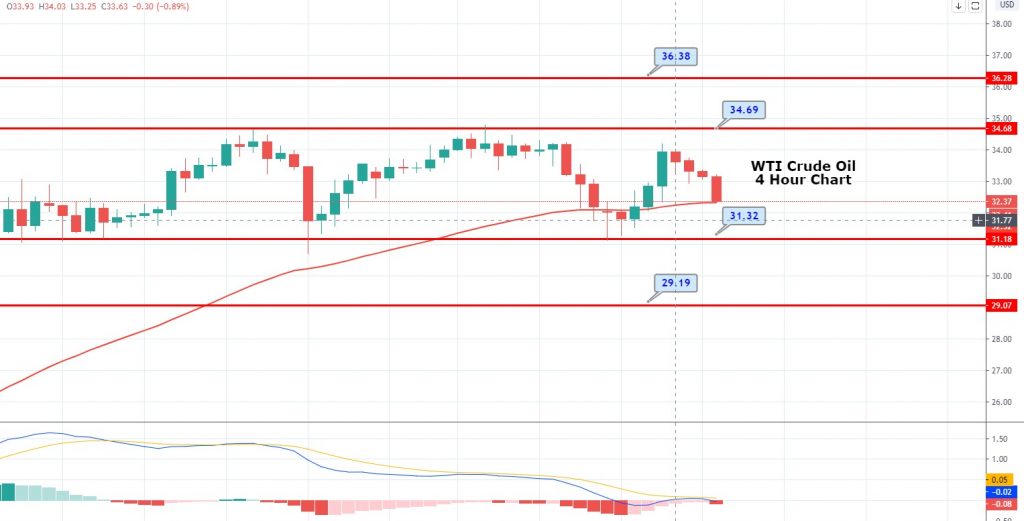

Daily Support and Resistance

S1 27.29

S2 29.96

S3 30.88

Pivot Point 32.64

R1 33.55

R2 35.31

R3 37.98

Crude oil is on a bearish run, trading at 32 level, holding right above the next support level of 31.40 level. The closing of candles above 50 EMA is suggesting the chances of a bullish trend in crude oil. On the higher side, oil may find resistance around 34.40 level, and bullish crossover of this may drive further buying until the next target level of 36.30. Let’s look for buying trades over 32.64 and selling below this.

All the best!