Daily Brief, Jun 12: Everything You Need to Know About Trading Gold Today

Gold prices closed at $1726.94 after placing a high of $1744.72 and a low of $1721.50. Overall the movement of gold remained bearish throughout the day. GOLD rose in the early trading session on Thursday above $1740 level on the back of risk-off market sentiment but failed to stay there and started to drop in the American session after the release of US economic docket.

On Thursday, an abrupt reversal in risk was seen after the fears of the second wave of coronavirus increased as a jump in affected cases across the globe started to appear after easing of lockdown restrictions even in the US. Gold took its pace in early sessions on the potential of the second wave of the virus, which could lead to a partial shutdown of the US economy. A rise in the number of infected cases from across the world raised fears amongst investors about the second wave of coronavirus and hence, the safe-haven metal gained on Thursday. Meanwhile, the release of PPI and jobless claims in the US economic docket gave strength to the US dollar and exerted pressure on gold.

At 17:30 GMT, the Core PPI for May came in line with the expectations of -0.1%. The Purchasing Price Index (PPI) for May surged to 0.4% from 0.1% of expectations and supported the US dollar. The Unemployment Claims for last week decreased to 1.542M from the expected 1.550M and supported the US dollar.

Gold started to fall after the US Department of Labor Statistics reported better than expected jobless claims on Thursday. Fewer number of Americans who applied for jobless benefits claim during last week, gave strength to the US dollar, which rose versus major currencies and exerted pressure on the yellow metal prices.

Furthermore, the pharmaceutical company named Moderna said that it was on pace to begin the final-stage trial of its vaccine for COVID-19 by July. Moderna was the first company to start human clinical trials of its vaccine in the US said on Thursday.

The last stage of the trial will be done in partnership of the US National Institute of Allergy and Infectious Diseases (NIAID). The study will include 30,000 people and will aim to show the definite clinical proof that vaccines prevent people from developing COVID-19. The latest update about the potential vaccine from one of the top pharmaceuticals in the US gave hopes for a virus-free economy, which exerted heavy pressure on safe-haven assets, including gold, which posted losses at the end of the trading day.

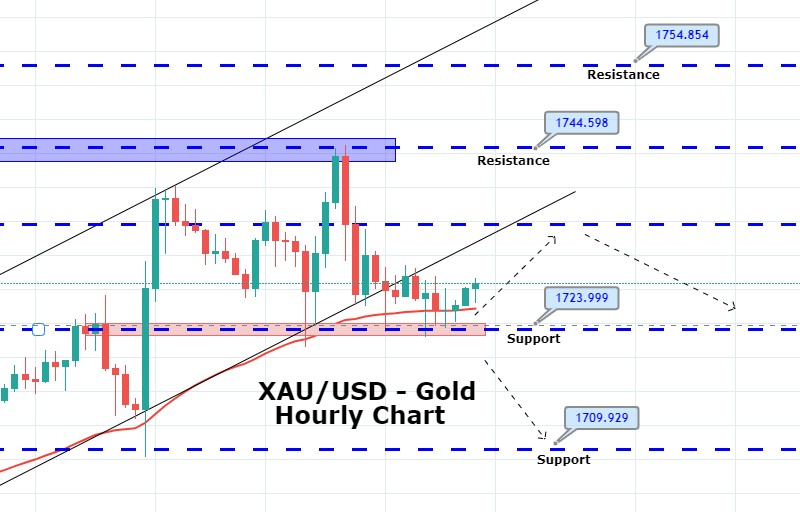

Daily Technical Levels

Support Resistance

1722.31 1749.46

1711.43 1765.73

1695.16 1776.61

Pivot Point: 1738.58

On Friday, the precious metal is finding support at 1,723 level, which is extended by a series of doji and spinning top patterns. Gold is currently holding around 1,726, but the bearish breakout of 1,723 can trigger sharp selling for the precious metal. On the lower side, the next support is likely to be found around 1,714 level today. The bullish bias remains strong above 1,723 until 1,736 level, while bearish bias will be stronger below 1,723 until 1,714 level.

Good luck!