Daily Brief, June 29 – Everything You Need to Know About Gold on Monday!

The yellow metal is trading at 1,767 level, staying right above a support level of 1,760. Over this level, the precious metal gold can lead

Good morning, traders,

Welcome back to another exciting week,. It’s going to be a busy week, especially because of the U.S. Non-farm payroll data due on Friday. Overall the market is likely to price in the U.S. labor market figures influential from Monday. Speaking about gold, the precious metal is still finding the safe-haven appeal for a series of events. Let’s check out together.

The yellow metal gold prices were closed at $1769.39 after placing a high of $1772.04 and a low of $1747.51. Overall the movement of gold remained bullish throughout the day. Gold erased its early day losses on Friday and posted gains at the end of the day due to increased coronavirus spread across the globe. The record jump in the U.S COVID-19 infections damaged the risk appetite and caused a surge in metal prices for the third straight week.

The COVID-19 has infected about 9.62M people worldwide, and the United States has set a new record for a one-day count in coronavirus cases. The U.S. reported more than 41,000 new COVID-19 cases on Thursday; however, the health officials said that the actual count was probably ten times greater than the official reported count. Almost 2.4M Americans have already been reported to be infected by the COVID-19, with a death toll breaching 123,000. According to a new model by the University of Washington, the number of deaths due to the novel coronavirus in the U.S. would increase to 200,00 by Oct. 01.

Meanwhile, investors got nervous due to rising count in the coronavirus cases and quit their positions in riskier assets like stocks, to move their investments into the gold and bonds. Wall Street Journals’ major indices and the 10-year Treasury yield slipped to its lowest since early June as the U.S. set a new record for a 1-day increase in coronavirus cases.

The yellow metal gold has gained almost 1.4% so far during the previous week, but it slipped from its weekly high level after its rival U.S. dollar took some shine off the precious metal. The rising number of coronavirus cases with no vaccine yet and additional stimulus measures by major central banks to reduce the impact of the COVID-19 crisis on the economy has increased the inflation concerns, which pushed gold prices about 16.5% higher this year.

On the data front, at 17:30 GMT, the Personal Spending from the U.S. was recorded as 8.2% against the expected 8.9% for May weighed on the U.S. dollar. The Revised UoM Consumer Sentiment for June dropped to 78.1 from the expected79.1 and weighed on the U.S. dollar. The weak U.S. dollar after economic data release gave a push to gold prices on Friday. Connecting all the dots, the market sentiment for gold continues to be bullish; hence we should look for bullish trades today. Now, let’s take a look at the technical outlook.

Daily Technical Levels

Support Resistance

1782.51 1788.76

1780.18 1792.68

1776.26 1795.01

Pivot point: 1786.43

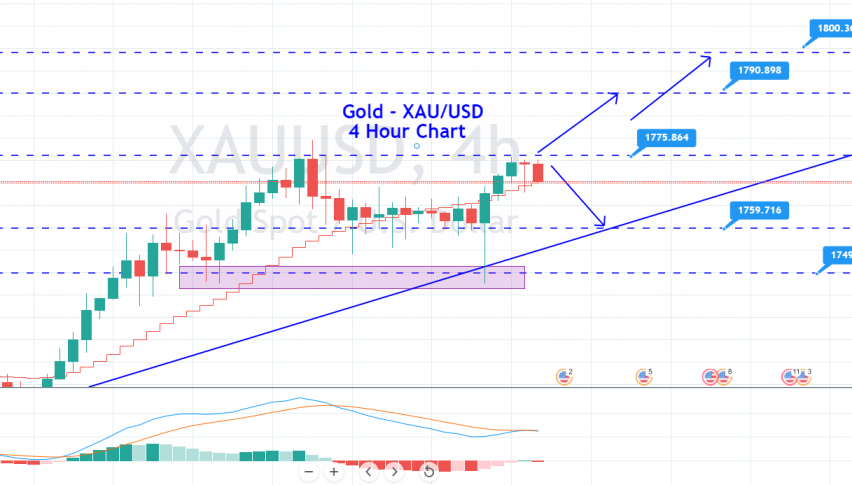

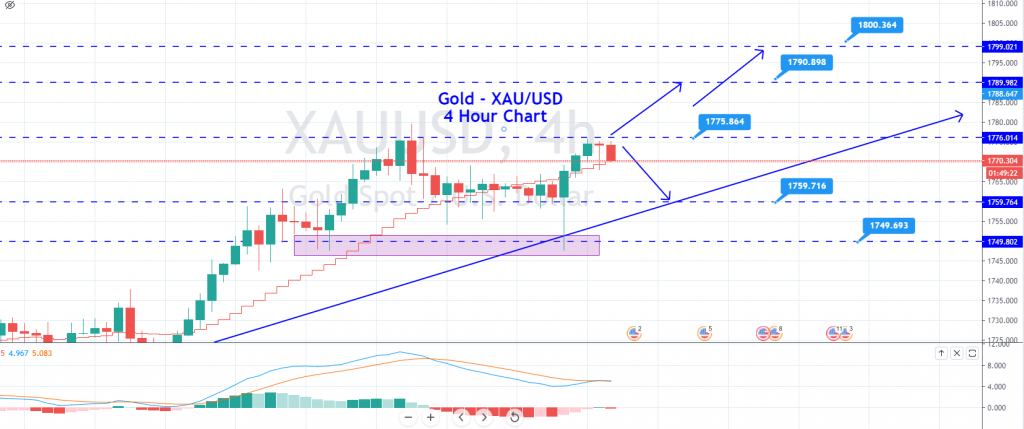

Technically, the precious metal GOLD was in a consolidation phase, and it could see a further rally towards $1800 level if investors became further risk-averse. The outlook for the global economy has worsened due to the rising number of virus patients, and investors were seeking safe-haven assets like gold to invest in such situations. Gold remained in demand despite a steady U.S. dollar and rising European shares.

At the moment, the yellow metal is trading at 1,767 level, staying right above a support level of 1,760. Over this level, the precious metal gold can lead the XAU/USD prices towards 1,773 and 1,778 while support continues to hold around 1,767 and 1,758. Let’s focus on 1,778 levels, and violation of this will drive movement in the market. Stay tuned for trading signals and more trade ideas today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account