GBP/USD Choppy Session Continues – Volatility Lacking on US Bank Holiday!

The GBP/USD is trading at the 1.2475 level, and it is finding immediate support at the 1.2358 level. Closing of candles above the 1.2404 le

The GBP/USD currency pair succeeded in putting a stop to its early day losses, taking fresh bids at around the 1.2480 level. The Cable represented 0.10% gains on the back of a risk-on market sentiment, triggered by the release of positive economic data from the US and China, which eventually undermined the broad-based US dollar, contributing towards the currency pair’s bullish moves. On the other hand, the fears of the high unemployment rate and Brexit worries in the UK have turned out to be one of the major events that have kept a lid on any additional gains in the currency pair, at least for now.

On the Brexit front, the policymakers from the European Union (EU) and the UK ended the Brexit trade deal discussions on a gloomy note, earlier than initially planned. The Bloc and Tory leaders urged both parties to cancel the Brexit discussions, rather than continuing for the first full week of the planned six-week series. Meanwhile, the EU’s Brexit chief, Michel Barnier, fired shots at the UK, in an attempt to stop the talks, which initially weighed on the cable currency. In the meantime, the UK’s chief Brexit negotiator, David Frost, confirmed that the two sides still have significant differences on several important issues surrounding the Brexit.

Apart from Brexit, the fears of tremendous job losses in the country coupled with UK PM Boris Johnson’s decision about not stretching the job-retention and furlough scheme, as per the Evening Standard, also weighed on the currency pair initially. It is worth recalling that almost 12,000 people in the UK were expected to lose their jobs instantly after firms announced cuts in the past 48 hours. Moreover, the UK’s decision about easing citizenship rules for Hong Kong citizens fueled anger from China.

On the other hand, the reason behind the risk-on market sentiment could be attributed to the better-than-expected United States Nonfarm Payrolls data. The NFP report indicated that the US economy created 4.8 million jobs in June, against market expectations of 3 million. In the meantime, the unemployment rate dropped more than expected, to 11.1% from the previous figure of 13.3%, boosting the investor’s confidence, as they believed that the worst of the coronavirus pandemic was over.

On the other hand, the upbeat trading sentiment was further bolstered by the reports of another vaccine trial for COVID-19, which showed positive results. It is worth mentioning that the US Pharmaceutical giant, Pfizer (NYSE: PFE), reported positive results from an early-stage human trial for BNT162b1, one of four mRNA candidates currently under development in a joint effort by the company and Germany’s BioNTech (NASDAQ: BNTX).

The broad-based US dollar reported losses on the day, possibly due to the modest upbeat trading sentiment, backed by the positive data from both China and the US, which gave a boost to the market sentiment. However, the losses in the greenback could be short-lived or temporary if coronavirus concerns overshadow upbeat US data, although, the losses in the US dollar turned out to be one of the key factors that kept the currency pair higher. The US Dollar Index that tracks the greenback against a basket of other currencies had slipped by 0.05%, to 97.248 by 12:37 PM ET (5:37 AM GMT). Looking forward, the virus and the tussle with China might help the greenback to recover the latest losses. In the absence of US players, due to the Independence Day long weekend, the global markets may witness a dull trading session ahead.

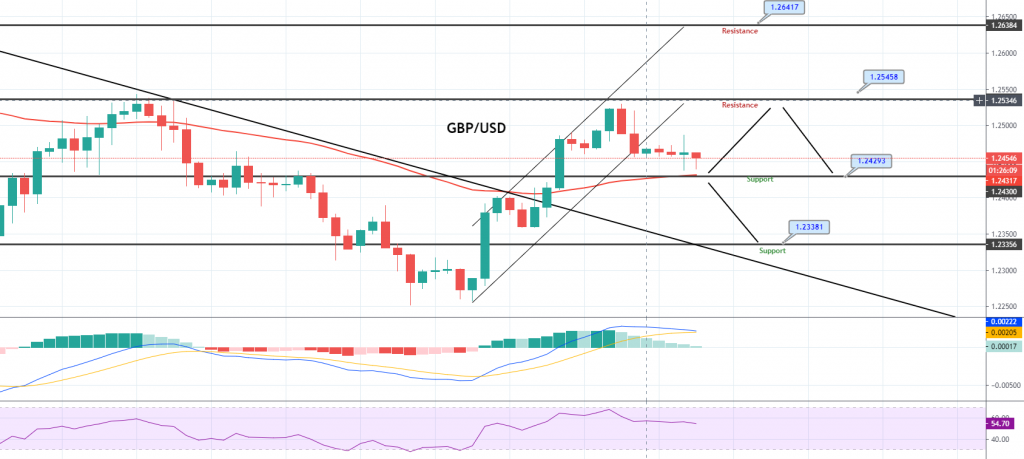

Daily Support and Resistance

S1 1.2338

S2 1.2412

S3 1.2441

Pivot Point 1.2485

R1 1.2514

R2 1.2559

R3 1.2633

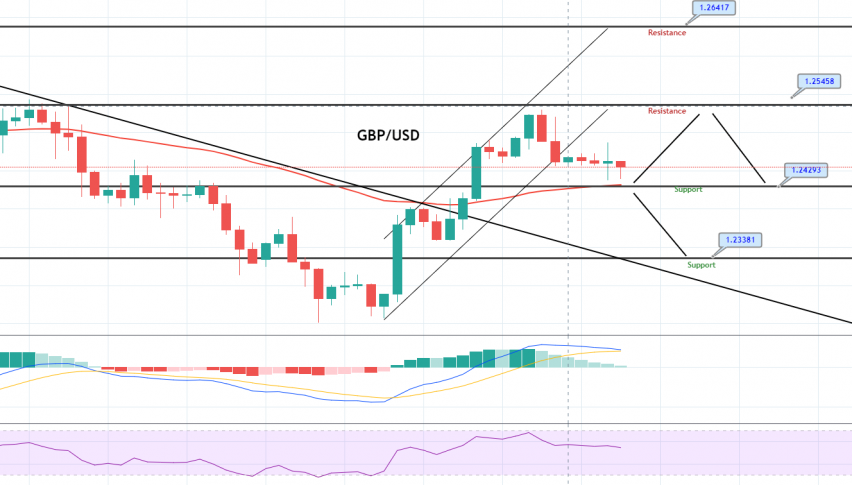

The GBP/USD is trading at the 1.2475 level, and it is finding immediate support at the 1.2358 level. Closing of candles above the 1.2404 level is driving further buys in Sterling, and this could push the GBP/USD prices higher, towards the 1.2530 and 1.2620 marks. The bullish breakout at the 1.2400 level could boost buys in Cable, pushing the prices towards the next target level of 1.2504. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account