Dollar Weakens as Traders Focus on Weak Economic Data From the US

The US dollar has weakened against major peers as traders focused on disappointing economic data releases from the US heightening worries

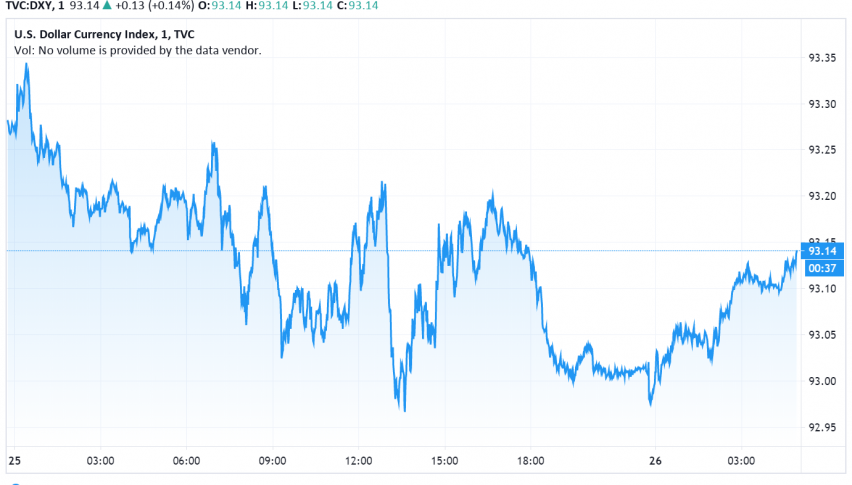

On Wednesday, the US dollar has weakened against major peers as traders focused on disappointing economic data releases from the US heightening worries about delayed recovery in the world’s largest economy. At the time of writing, the US dollar index DXY is trading around 93.14.

During the previous session, the US consumer confidence fell to an over six year low as a result of the rising unemployment levels. Later today, the US dollar could see some movement on the release of core durable goods orders, account key data point that showcases the state of the US economy.

The dollar is also trading cautious in anticipation of Thursday’s Jackson Hole symposium where Fed chair Jerome Powell is expected to reveal the central bank’s strategy to offer more support to the US economy that is reeling under the impact of the ongoing coronavirus pandemic.

Meanwhile, the Chinese Yuan strengthened to the highest levels in nearly seven months against the US dollar over optimistic comments from officials from the US and China about their renewed commitment towards implementing the phase one trade deal. The possibility of receding trade tensions between the world’s two largest economies has further dented the safe haven appeal of the greenback, sending it lower.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account