US Dollar Languishes Close to Two-Year Lows Due to a Dovish Fed

A continued focus on the recent insights from the Fed into its monetary policy weighs on the US dollar into Tuesday, sending it to the

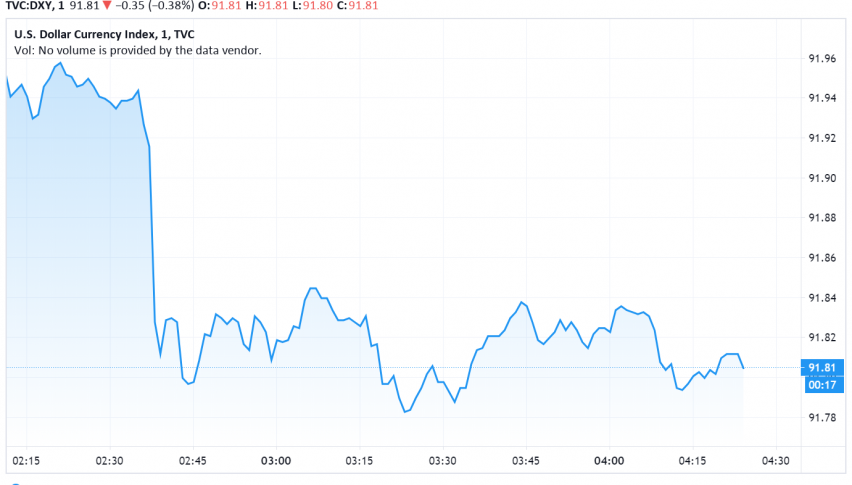

A continued focus on the recent insights from the Fed into its monetary policy weighs on the US dollar into Tuesday, sending it to the weakest levels against its major peers in over two years. At the time of writing, the US dollar index DXY is trading around 91.81.

The US dollar, which had strengthened initially when the pandemic started spreading across the world, is now weakening not only against major currencies but also against emerging market currencies. Analysts take this as a sign that the dollar is expected to continue trading bearish for some time to come.

The US dollar has been falling as a result of expectations that the Fed could hold interest rates at low levels for a longer period of time. With the pandemic still raging on and hurting the US economy, the central bank plans to focus more of its efforts in reviving economic growth, which could keep the monetary policy dovish for more time.

Additional weakness in the dollar was driven by a decline in US Treasury yields during the previous session. Later today, the reserve currency could see some movement on the release of manufacturing data from the US.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account