Risk-off Sentiment Supports US Dollar Amid Second Wave Fears

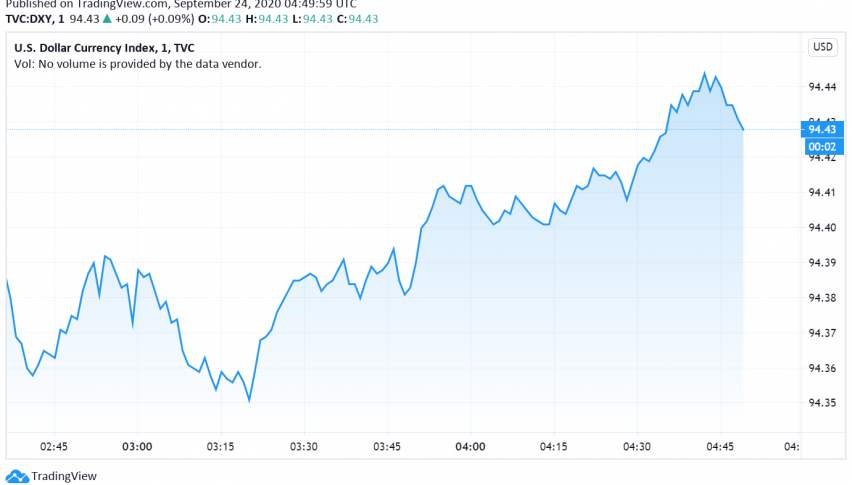

The US dollar continues to strengthen against major rivals into Thursday, supported by rising fears about a second wave of coronavirus setting back economic recovery, especially in Europe and the US. At the time of writing, the US dollar index DXY is trading around 94.43.

The common currency Euro has already weakened after several European cities announced fresh restrictions to curb the spread of the virus. Later today, EUR/USD could dip further in case the German business sentiment comes in weak and disappoints traders further.

The safe haven appeal of the US dollar is likely to continue strong as a result of a prevailing risk-off sentiment in global markets. As coronavirus cases climb higher across the US and most parts of the world, Fed officials have insisted on the importance of more stimulus to support the US economy.

Investors also turned away from risk assets and into the safety of the greenback after economic data released in the previous session revealed a slowdown in business activity in the US. While the manufacturing sector continued to grow, the pace of growth has weakened, with the manufacturing PMI sliding lower from 54.6 in August to 54.4 in September.