The AUD/USD Falls on More Rate Cut Talk

If a rate cut wasn't locked in previously, surely after today's comments it looks like a done deal.

If a rate cut wasn’t locked in previously, surely after today’s comments it looks like a done deal.

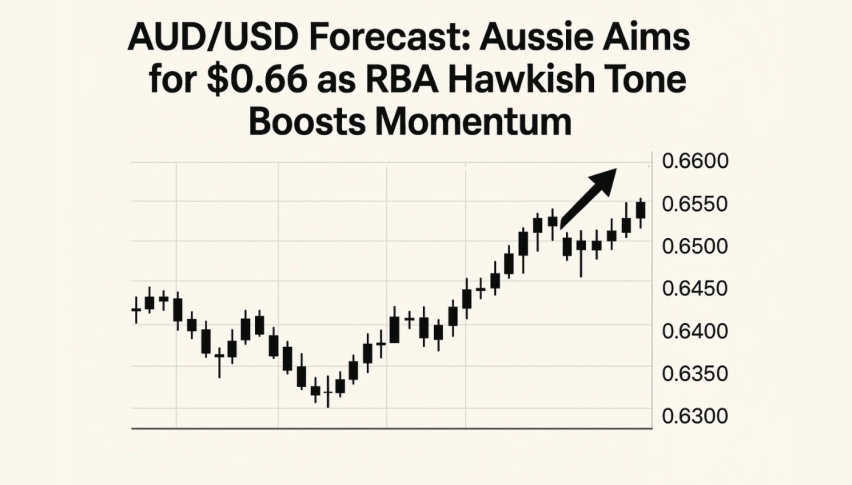

After a host of RBA speakers, today board member Christopher Kent has come out and said that there is a need for more policy support for some time to come. This means that we will likely be seeing a rate cut to 0.1% from 0.25% at the November meeting and possible even more things on top of that.

This all comes after we first heard from the deputy Governor who floated the idea a few weeks ago and then, of course, Governor Lowe who pencilled in a cut just last week.

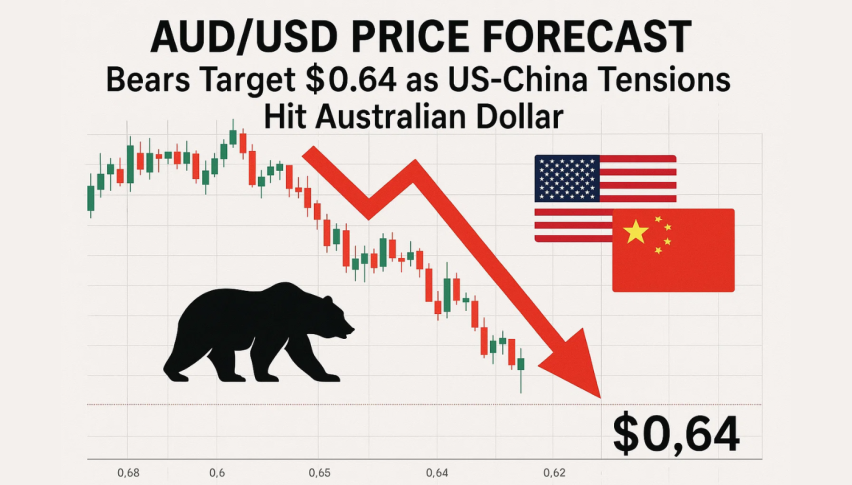

As a result the AUD/USD has been one of the weakest performers recently. Prior to the Kent comments price was up near the 0.7250 level and since that point, it has continued to fall.

After taking out the 0.7100 level it now looks like a near-certainty that price will be testing the all-important 0.7000 level. There was a bit of support yesterday on a short-term basis above the 0.7066 level or thereabouts, but after a short-lived rally, the bears are back in control once again.

We can probably key off the 0.7050 level to some degree. If price drops that level and holds, then surely the 0.7000 will be tested. At the same time, that support turned resistance around 0.7066 will come into play and good be an area to bounce off or use as a stop.

Either way, there should be some opportunities to the downside ahead. This all comes on top of the fact that risk assets are having a hard time thanks to the stalemate in Washinton on stimulus, but at the same time, this is also the major risk factor for a short position.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account