Daily Brief, Nov 12 – Everything You Need to Know About Gold Today

The precious metal gold prices were closed at 1865.19 after placing a high of 1884.47 and a low of 1856.36. [[Gold]] prices fell about 1.1%

Good morning traders,

Prices for the precious metal, GOLD, closed at 1,865.19, after placing a high of 1,884.47, and a low of 1,856.36. GOLD prices fell about 1.1% on Wednesday, due to the stronger US dollar and the optimism surrounding the potential COVID-19 vaccine, which has raised hopes for a quick economic rebound, ultimately driving investors towards riskier assets.

The strong equities and the strong US dollar and US Treasury yields made it hard for GOLD to continue to rally, and the yellow metal started to fell on Wednesday. The coronavirus vaccine news removed last week’s flight to the safety of the precious metal, after the US election, and weighed on the GOLD prices.

The US dollar index rose by about 0.3% to a one-week high, making the GOLD prices weak on Wednesday. The chances of an effective coronavirus vaccine overshadowed the worries over rising numbers of COVID-19 infections, and increased the risk sentiment, putting further pressure on the safe-haven metal, GOLD, on Wednesday.

However, the vaccine breakthrough raises many challenges, including the distribution of hundreds of millions of vaccine doses once they become available. These challenges kept the losses in GOLD prices limited on Wednesday. Some analysts believe that the longer-term prospects for GOLD are still bullish, as the road to recovery for the global economy will be long. Further support from governments and central banks will also be needed, which will help GOLD move higher ultimately. The Federal Reserve once again highlighted the need for more targeted fiscal support from the government on Tuesday.

GOLD prices have gained about 22% this year, on the back of stimulus measures delivered by central banks, as GOLD is widely viewed as a hedge against inflation and currency debasement. However, some analysts believe that the reaction to the vaccine news in recent days has been very strong, which has caused an immediate increase in the downside risk for GOLD .

Meanwhile, on Wednesday, Federal Reserve vice chair of supervision, Randal Quarles, said that the Fed’s backstop lending might not answer all issues facing state and local governments, and municipalities. No macroeconomic data was released in the United States on Wednesday, due to a Bank Holiday, so the GOLD prices continued following the market mood and vaccine news.

In addition to the US, Europe also imposed lockdowns again last week, which threaten to undermine the oil demand. As per the latest report, Sweden has declared a partial lockdown, ordering the shutting down of bars and restaurants for the first time since the virus started spreading across Scandinavia. Thus, the back to back lockdown restrictions will have an instant negative effect on transportation fuel, as more people will stay home in the evening hours.

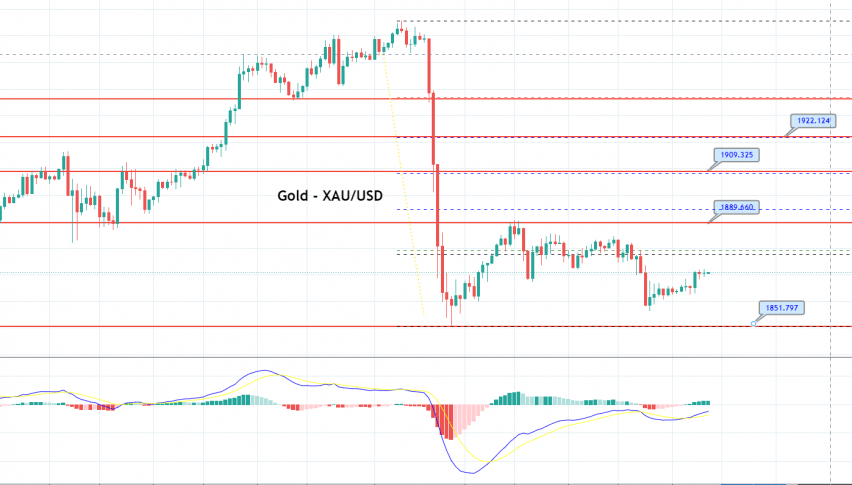

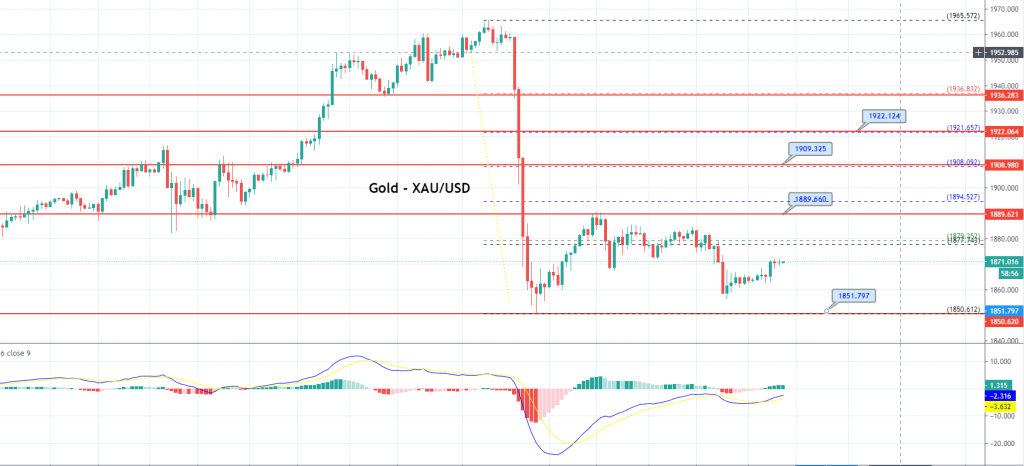

Support Resistance

1,850.79 1,879.14

1,838.22 1,894.92

1,822.44 1,907.49

Pivot Point: 1,866.57Trading in the precious metal, gold, continued to be bearish, on the back of a stronger dollar and faded safe-haven appeal. On the lower side, the precious metal GOLD may find support at the 1,851 level and resistance at the 1,880 level. Continuation of a further upward trend could lead the precious metal GOLD to the 1,909 area. The MACD is neutral; however, the odds of sideways treading remain strong between 1,889 and 1,851. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account