Surge in Cases and Biden’s Transition Concerns Weaken the US Dollar

The US dollar is exhibiting signs of weakness on Tuesday as a resurgence of fresh coronavirus cases across the country weighed on the

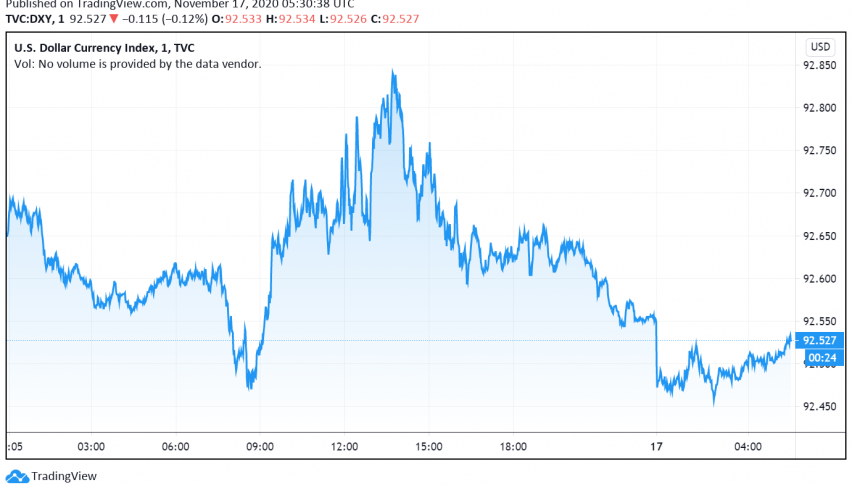

The US dollar is exhibiting signs of weakness on Tuesday as a resurgence of fresh coronavirus cases across the country weighed on the sentiment and concerns rose about transition of power from President Trump to President-elect Joe Biden. At the time of writing, the US dollar index DXY is trading around 92.52.

The sense of optimism in global financial markets about another promising vaccine against COVID-19, this one by Moderna, failed to support the greenback as the US faces severe challenges in containing the spike in fresh cases. With the onset of winter, cases and hospitalizations are climbing higher at a rapid pace, weakening investor confidence in the US dollar for now.

The US dollar is also subdued amid fears that the Trump administration may fail to work well and make the transition to Biden’s team an easy one. In addition, there is considerable uncertainty about how Biden is planning to combat the pandemic and what kind of stimulus measures he would announce.

Meanwhile, the GBP has strengthened against the US dollar over hopes that the UK and the EU could finally work out a trade agreement by as soon as next week. While the Euro continues to trade weak against the greenback due to the second wave of coronavirus across Europe, the Japanese yen is holding steady for now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account