Gold Dips as Markets Focus on Uncertainty Around US Stimulus

Gold is trading somewhat bearish after fresh news reports indicate that Republican leaders in the Senate are set to resume negotiations on

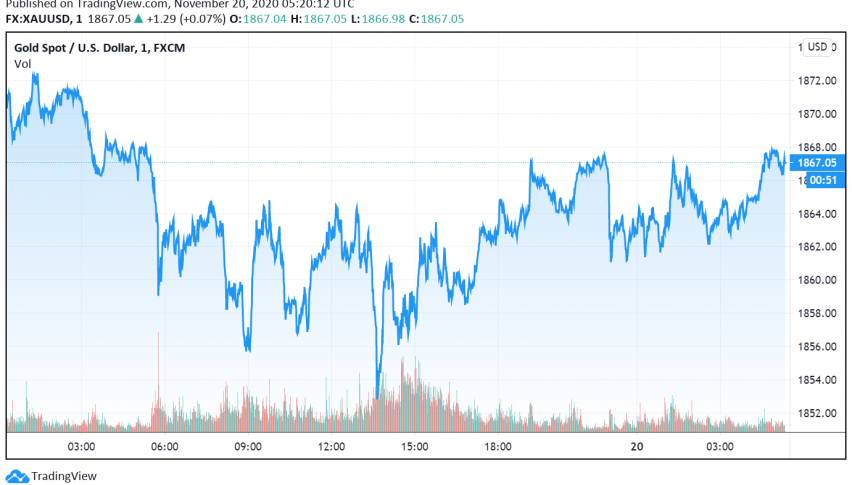

Early on Friday, gold is trading somewhat bearish after latest news reports indicate that Republican leaders in the Senate are set to resume negotiations on the coronavirus relief bill even as Treasury Secretary Mnuchin announced an end to Fed’s emergency lending initiatives. At the time of writing, GOLD is trading at a little above $1,867.

After several weeks of uncertainty, the next round of fiscal stimulus measures could get finalized soon with Republicans signaling their interest to restart discussions. While more stimulus measures typically support the safe haven appeal of gold, the heightened uncertainty about the more stimulus in the US has exerted downward pressure on the yellow metal for now.

Losses in gold, however, remain limited over worries about the continued increase in coronavirus cases across the US and several parts of the world. The initial optimism surrounding vaccines that saw markets rally over the past few sessions is fading as more governments announce fresh restrictions and lockdown measures to curb the spread of the pandemic, which could drive further damage to the global economy.

The IMF and G20 nations have already cautioned that more lockdowns could further delay economic recovery worldwide, giving the safe haven appeal of gold some support. According to them, “If new outbreaks require more stringent mobility restrictions, or if the development, production, and widespread distribution of vaccines and treatments is delayed, social distancing will persist for longer.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account