US Dollar Set to Post Weekly Decline Over Vaccine Optimism

The US dollar is trading somewhat steady early on Friday after experiencing thin trading due to the Thanksgiving holiday, but is set to post

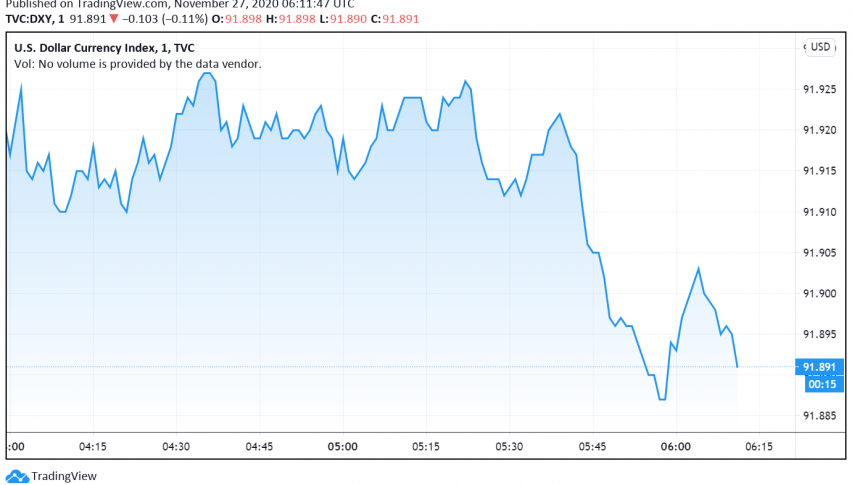

The US dollar is trading somewhat steady early on Friday after experiencing thin trading due to the Thanksgiving holiday, but is set to post a weekly loss against its major peers. At the time of writing, the US dollar index DXY is trading around 91.89.

The improvement in the risk appetite amid reports from three pharmaceutical companies on development of promising vaccines against COVID-19 helped strengthen the risk-on sentiment in global markets, and weakening the safe have appeal of the US dollar in turn. The dollar has been trading bearish since the past few sessions as hopes about vaccines sent traders towards riskier instruments instead.

Analysts expect the US dollar to continue trading weak in the near future over the vaccine optimism but their mid-term outlook for the reserve currency forecasts a regaining of strength. This is because the manufacturing and distribution of vaccines could take a few months and economic recovery could be gradual even after the vaccine rollout begins.

The Euro, meanwhile, is trading weak against the US dollar after the ECB’s chief economist hinted at the possibility of more stimulus measures being announced next month. In addition, the minutes from last month’s meeting also indicate rising worries about the economic impact of the second wave of the pandemic, which seem suggestive of more stimulus announcements.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account