Renewed Hopes For Fiscal Stimulus, Risk Appetite Weaken US Dollar

he US dollar is trading close to the lowest level in 30 months as the risk sentiment in global markets improves over optimism related to

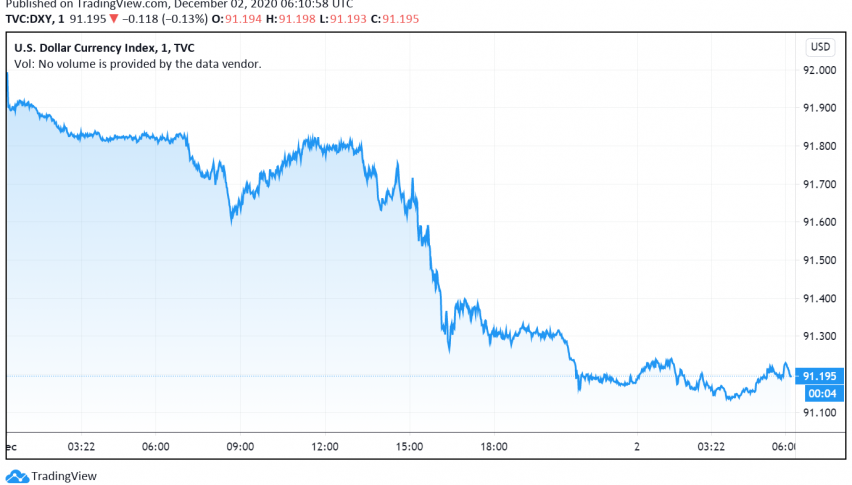

Early on Wednesday, the US dollar is trading close to the lowest level in 30 months as the risk sentiment in global markets improves over optimism related to vaccine developments even as traders await more fiscal stimulus to support the US economy. At the time of writing, the US dollar index DXY is trading around 91.19.

The safe haven appeal of the US dollar has suffered over the past couple of weeks ever since pharmaceutical companies reported progress in developing effective vaccines against COVID-19. The positive news improved investor confidence and supported hopes of economic recovery around the world, sending traders away from the greenback and turning riskier currencies stronger.

Additional bearishness in the reserve currency was triggered after US Treasury Secretary Steven Mnuchin and House of Representatives’ Speaker Nancy Pelosi held their first round of talks on the coronavirus relief aid after the presidential election. A group of senators from both parties has also recommended stimulus measures worth around $908 billion to offset some of the economic damage caused by the pandemic.

Pelosi confirmed that she and Mnuchin would review proposals for more relief measures. Expectations for more stimulus measures strengthened further, sending the US dollar weaker as a result, after Fed Chair Jerome Powell and Mnuchin insisted that Congress offer more financial assistance to small businesses to overcome the economic impact of the pandemic.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account