US Dollar’s Safe Haven Appeal Dips – Fiscal Stimulus, Brexit Deal Hopes in Play

The US dollar has weakened against other major currencies on Tuesday amid rising hopes for progress towards the next round of fiscal

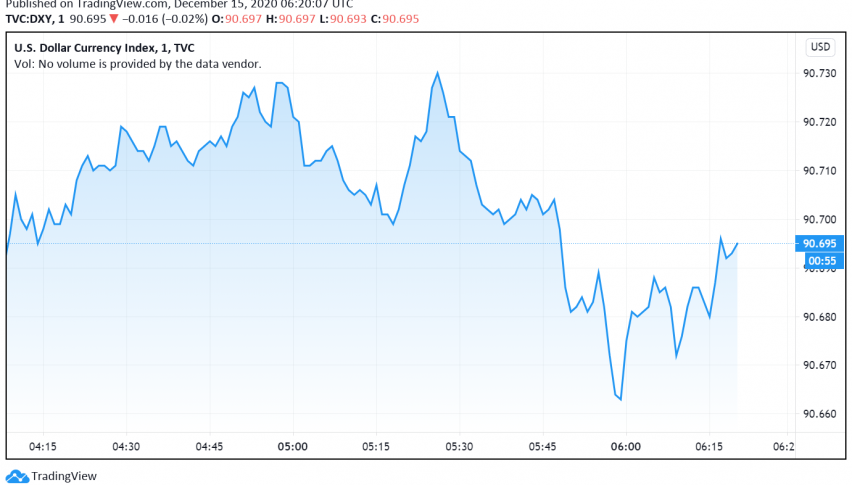

The US dollar has weakened against other major currencies on Tuesday amid rising hopes for progress towards the next round of fiscal stimulus measures in the US and for Britain and the EU to work out a post-Brexit trade deal soon. At the time of writing, the US dollar index DXY is trading around 90.69.

The safe haven appeal of the US dollar is under pressure as markets trade with a risk-on sentiment over reports that lawmakers in the US are getting ready to approve a coronavirus relief package soon. A bipartisan group has proposed a smaller package consisting of relief measures worth $748 billion as a compromise, in the hopes for quick rollout.

Meanwhile, the demand for the greenback has also suffered as the risk sentiment received a boost after chief Brexit negotiator for the EU, Michael Barnier, maintained that a EU-UK trade deal was still possible. Barnier’s comments helped ease worries of a no-deal Brexit, increasing investor confidence in trading riskier instruments.

The risk-on sentiment also remains supported as Britain, Canada and the US begin rolling out the COVID-19 vaccine. Markets are hoping that the vaccine will bring down the recent spike in infections and help economies recover from the steep downturn caused by the pandemic.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account