WTI Crude Oil Bullish as API Reports Greater Drawdown in Stockpiles

Bullish trading in WTI crude oil continues into Wednesday as optimism surrounding the coronavirus relief package and a drop in US crude

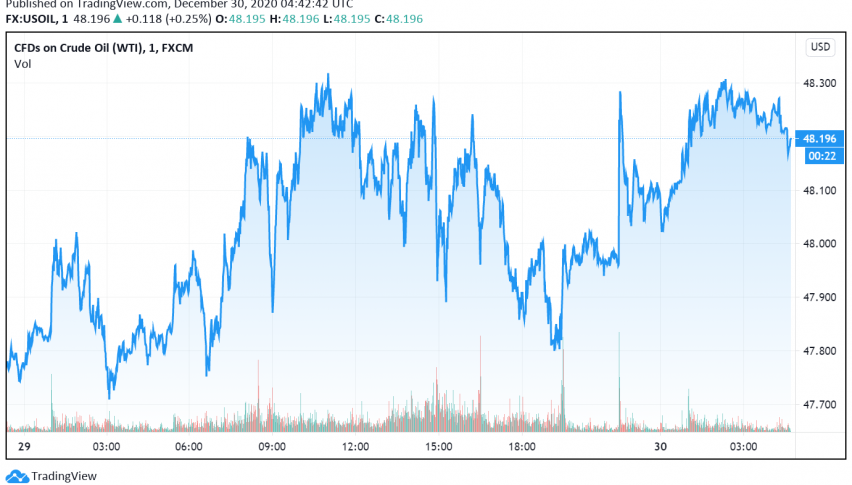

Bullish trading in WTI crude oil continues into Wednesday as optimism surrounding the coronavirus relief package and a drop in US crude inventories boost the sentiment in oil markets. At the time of writing, WTI crude oil is trading at around $48.19 per barrel.

Earlier this week, US President Donald Trump signed the coronavirus relief bill and received support from the House of Representatives for his proposal to increase stimulus checks’ payments from $600 to $2,000. This news lent support to oil prices in the hopes that it could spur fuel demand across the world’s largest energy consumer.

During the previous session, WTI crude oil prices also strengthened on the release of the API report which revealed a drop of around 4.8 million barrels in US crude stockpiles over the past week. The decline even beat economists’ forecasts, which was for a 2.6 million barrel drawdown instead.

In addition, a weakness in the US dollar is also driving bullishness in WTI oil. As we know, crude oil shares a negative correlation with the greenback – whenever the value of the dollar falls, oil becomes more affordable for holders of other currencies.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account