Crude Oil Ends 2020 Around 20% Lower – Pandemic, Lockdowns Weigh

As 2020 draws to a close, crude oil prices have suffered a loss of around 20% on account of the coronavirus pandemic and ensuing lockdowns

As 2020 draws to a close, crude oil prices have suffered a loss of around 20% on account of the coronavirus pandemic and ensuing lockdowns. However, the last few weeks of the year offered some respite to the decline due to optimism around the development and rollout of COVID-19 vaccines, the Brexit deal and even the coronavirus relief package.

The severe lockdowns and restrictions, especially on international travel, that were imposed at the beginning of the pandemic sent oil demand crashing earlier this year. While demand began to recover as economies began to reopen, towards the end of the year, the resurgence in fresh cases especially across Europe and the US led to the reimposition of lockdowns, weighing on oil demand once again.

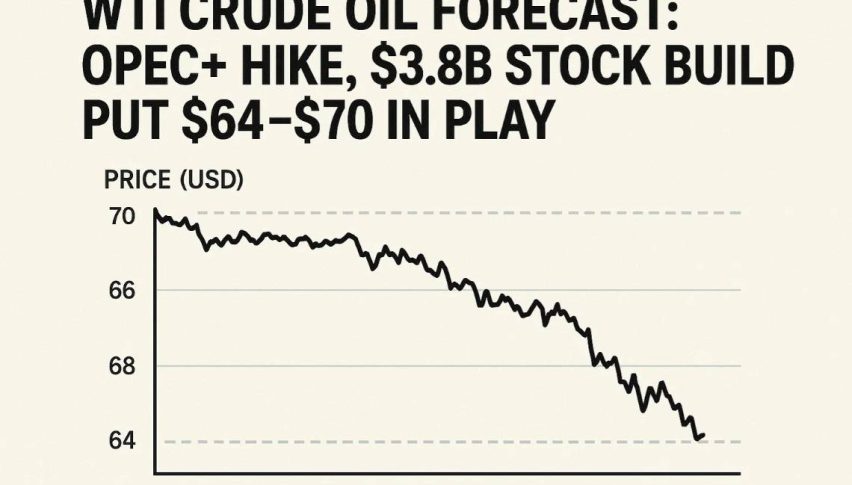

Although leading oil producers of the world, OPEC and its allies, tightened oil supply, the move was unable to offset the more severe decline in demand, keeping crude oil prices weaker through most part of 2020. In April, both crude benchmarks fell to record lows, with WTI falling into negative territory for the first time ever.

In the near term, crude oil prices are likely to enjoy support from a weakness in the US dollar, driven by uncertainties surrounding the release of the next round of fiscal stimulus measures to support the US economy. There also lingers some hope among oil traders that the vaccine rollout can help contain the pandemic in the coming months, and help oil demand rebound.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account