Daily Brief, January 18 – Everything You Need to Know About Gold on Monday!

During Monday’s Asian trading hours, the yellow metal succeeded in putting a stop to its early-day losing streak and picked up some modest bids around the $ 1,830 level, as the market investors turned to the safe-haven precious metal due to the rising number of COVID-19 cases and dismal US economic data.

Apart from this, the cautious sentiment ahead of the start of US President-elect Joe Biden’s term of office and the lack of any major data/events, coupled with a long weekend in the US, has kept the risks heavy, lending some additional support to the safe-haven metal prices. As we are all well aware, Mr. Biden has already rolled out a huge coronavirus (COVID-19) stimulus package to the tune of $ 1.9 trillion, but the latest chatter surrounding the cancelation of the Keystone XL pipeline permit via executive action on his first day of office keeps exerting downside pressure on the market sentiment.

In contrast to this, the prevalent bullish bias surrounding the US dollar, backed by the risk-off market mood, turned out to be one of the leading factors that has kept a lid on any additional gains in the yellow-metal prices, as the price of GOLD is inversely related to the price of the US dollar. Meanwhile, the latest claim by vaccine producers, that they have the ability to tame the coronavirus variants, is helping to limit deeper losses in the market trading sentiment, which might put some pressure on the yellow metal prices. Gold is currently trading at 1,837.93, and consolidating in the range between 1,804.39 and 1,839.54.

The global equity market failed to stop its negative performance of last week, remaining sour on the day amid the lack of major data/events and a long weekend in the United States. In the meantime, the cautious sentiment ahead of US President-elect Joe Biden’s first day in office has also exerted downside pressure on the market sentiment. As per the latest rumors, Biden is expected to cancel Canada’s Keystone XL pipeline permit, and this is putting pressure on the market sentiment and supporting safe-haven assets. Besides this, another reason for the risk-off market sentiment could also be associated with upcoming Treasury Secretary Janet Yellen’s commitment to the market-determined value of the dollar. Additionally, the coronavirus (COVID-19) woes and doubts over the economies of the US and China are creating an extra burden that is weighing on the market trading sentiment. The doubts over economic recovery were fueled after the US and China released mixed economic data.

On the US data front, the core retail sales declined by 1.4% month-on-month in December, which was higher than both the 0.1% contraction in the forecasts and the 1.3% contraction recorded in November. Meanwhile, the Producer Price Index (PPI) increased by 0.3% month on month in December, while retail sales declined by 0.7% in the same month.

On the Chinese data front, China’s 4th quarter (Q4) GDP increased from 6.1% to 6.5% YoY, but it eased on a QoQ basis, to 2.6%, against the projected 3.2%, and the previous 2.7%. Moreover, Industrial Production for December grew past the expected 6.9%, to 7.3% YoY, while Retail Sales fell below the previous readout of 5.0% and the 5.5% market consensus.

Besides sides this, another reason for the negative trading sentiment could also be attributed to the worries about rising numbers of COVID-19 cases and economically-painful hard lockdowns, which boosted the safe-haven US dollar.

The broad-based US dollar managed to extend its overnight gains, remaining bullish on the day, as investors still prefer to invest in the safe-haven assets, in the wake of the risk-off market sentiment. However, the gains in the US dollar seem rather unaffected by the downbeat US data. Thereby, the gains in the US dollar have become a key factor that has kept a lid on any additional gains in the gold prices, due to the inverse relationship between the prices of GOLD and the greenback.

Conversely, the decreasing numbers of coronavirus cases in the UK have helped to limit deeper losses in the market trading sentiment. As per the latest report, the UK reported 38,598 new coronavirus cases on Sunday, which is the lowest number since December 27. The United Kingdom will start offering doses of vaccine to people aged 70 and above, and to those considered clinically extremely vulnerable to the coronavirus. Thus, the rolling out of the vaccines will ease some of the economically damaging lockdown restrictions in March.

In the absence of any major data/events on the day, the market traders will keep their eyes on the speech by BOE Gov Bailey and the Candian Housing Starts. In the meantime, the risk catalysts, like geopolitics and the virus woes, will also be essential to watch.

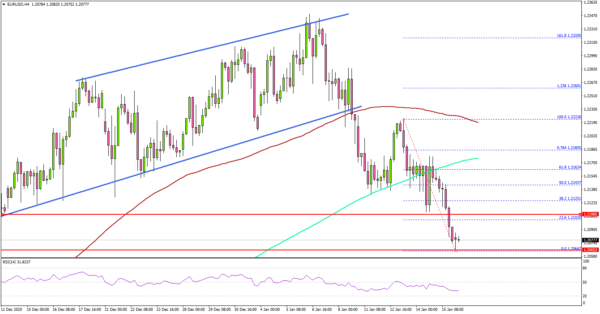

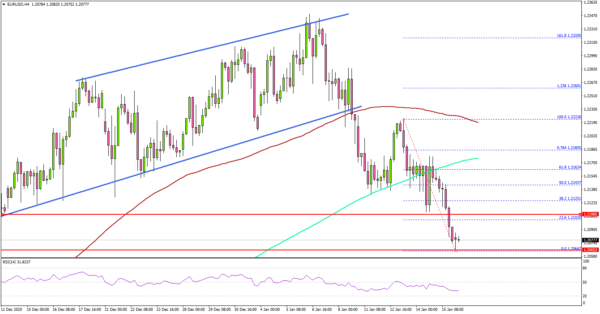

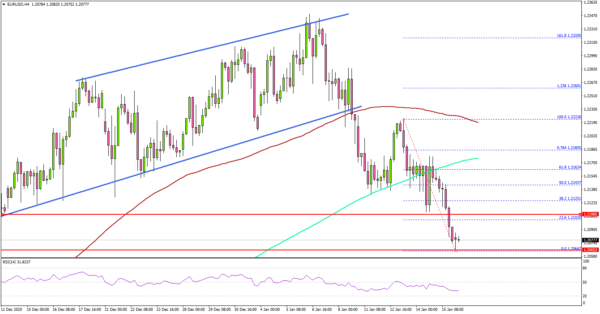

Daily Support and Resistance

S1 1,769.19

S2 1,802.78

S3 1,815.73

Pivot Point 1,836.36

R1 1,849.32

R2 1,869.95

R3 1,903.53

Trading in GOLD was sharply bearish, at 1,801, before it bounced off to trade at the 1,831 level, which worked as resistance. On the higher side, a bullish breakout at 1,831 could extend the buying trend and lead the gold price towards the next target areas of 1,841 and 1,846, while the support may remain at 1,831. The RSI and MACD suggest chances that the buying trend could continue today. Good luck!