WTI Crude Oil Steady as Markets Worry About Further Weakness in Demand

WTI crude oil is exhibiting signs of mixed trading as the optimism surrounding deeper supply cuts by Saudi Arabia and decline in US crude

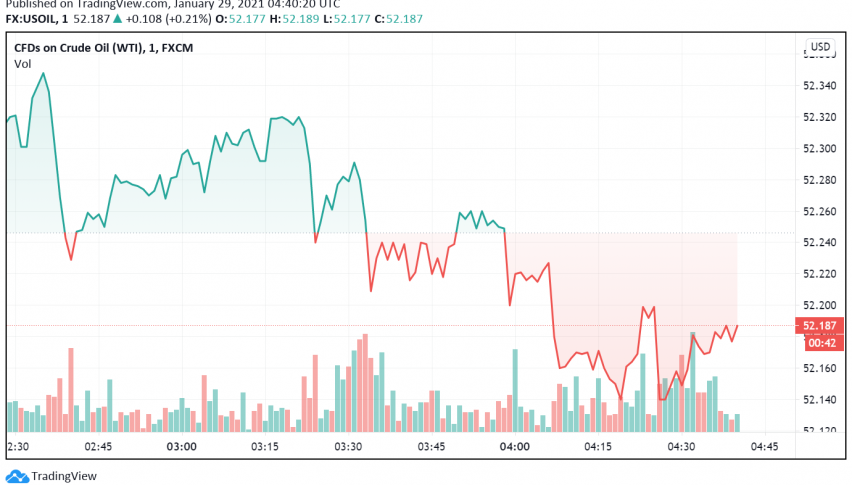

Early on Friday, WTI crude oil is exhibiting signs of mixed trading as the optimism surrounding deeper supply cuts by Saudi Arabia and decline in US crude stockpiles were balanced by escalating concerns about the new strains of the coronavirus and resulting lockdowns hurting demand further. At the time of writing, WTI crude oil is trading at around $52.18 per barrel.

During the previous session, WTI crude oil prices fell by around 1% as restrictions continued even as markets worried about the fallout of the latest round of fresh outbreaks across China. With the Lunar New Year just around the corner, authorities have already begun to urge citizens from restricting their travel – a factor that could weaken the demand for jet fuel considerably during the busiest travel season of the year across the world’s second largest energy consumer.

On a positive note, however, Saudi Arabia is expected to curb crude supply by an additional 1 million bpd during February and March, even as latest reports point to improvement in compliance with supply cuts across OPEC+ countries. Saudi Arabia’s latest supply cuts, which were announced at the latest OPEC+ meeting earlier this month, will reduce oil supply by 8.125 million bpd starting next week.

However, the overall sentiment among oil traders remains cautious as COVID-19 vaccine rollouts stall due to distribution related challenges across Europe and the US. In addition, the discovery of more contagious strains of coronavirus has increased the likelihood of more lockdowns and restrictions, which could further weaken the demand for crude oil.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account