Daily Brief, February 17 – Everything You Need to Know About Gold Today!

The GOLD prices closed at 1,794.26, after placing a high of 1,826.36, and a low of 1,789.41. GOLD continued its bearish move for the fourth consecutive session, dropping to the lowest level since February 5 on Tuesday, amid stronger US Treasury yields.

The prospects of the US stimulus package proposed by US President Joe Biden, to the tune of $ 1.9 trillion, supported the optimism and pushed the US stock indexes to an all-time high. Meanwhile, the US 10-year Treasury note yields also hit a session high, above 1.3%, which was the highest in a year. The US Dollar Index remained steady above 90.5 on Tuesday, and continued weighing on the GOLD prices.

The yields on global bonds rose on reflation bets and triggered a slow-down in many safe-haven trades. GOLD is considered as an inflation hedge, and the massive economic stimulus is expected to increase inflation; and these bets have increased the opportunity cost of non-yielding GOLD, ultimately causing a decline in the yellow metal prices.

Investors believe that the Federal Reserve will soon roll back coronavirus stimulus measures, which will ultimately kick in the economic recovery in the coming months, and this has caused a rise in bond yields. But, although the Federal Reserve has denied that the so-called tapering will happen quickly, the markets were following the optimism due to declining numbers of coronavirus cases and hospitalizations in recent days.

According to the Associated Press, the average daily number of new coronavirus cases in the US has dropped below 100,000 for the first time in months. According to data from the COVID Tracking Project, coronavirus hospitalizations have also dropped from a high of 132,000 to 65,000.

As for new variants of coronavirus that appear to be more contagious and could lead to higher infection rates, hospitalizations and deaths, public health officials are monitoring the developments closely. The US has reported 1,173 cases of the UK variant and around 17 cases of the South African variant in eight states, along with three Brazilian variants in Minnesota and Oklahoma.

He downplayed the shifted expectations and noted that there would be several months between the general availability of vaccinations and individual access for each person. Fauci’s comments came in as the US coronavirus count reached its lowest level since October, and it supported the hopes of economic recovery, ultimately adding to the risk sentiment and weighing heavily on the yellow metal prices.

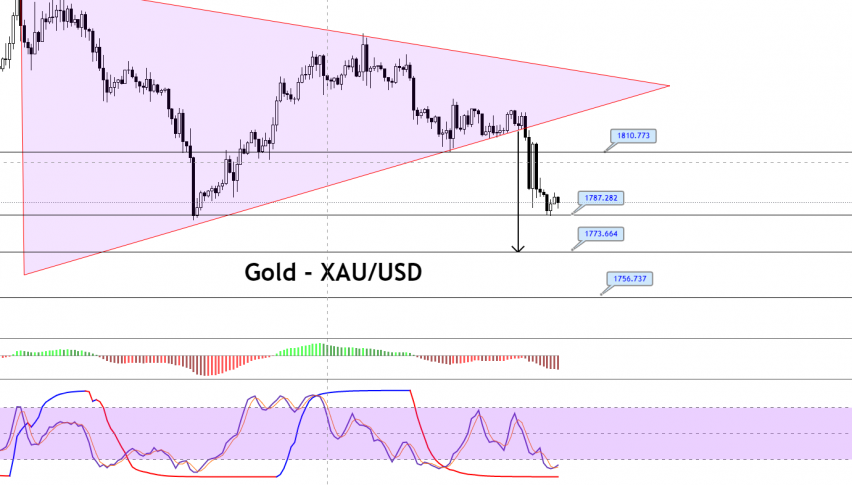

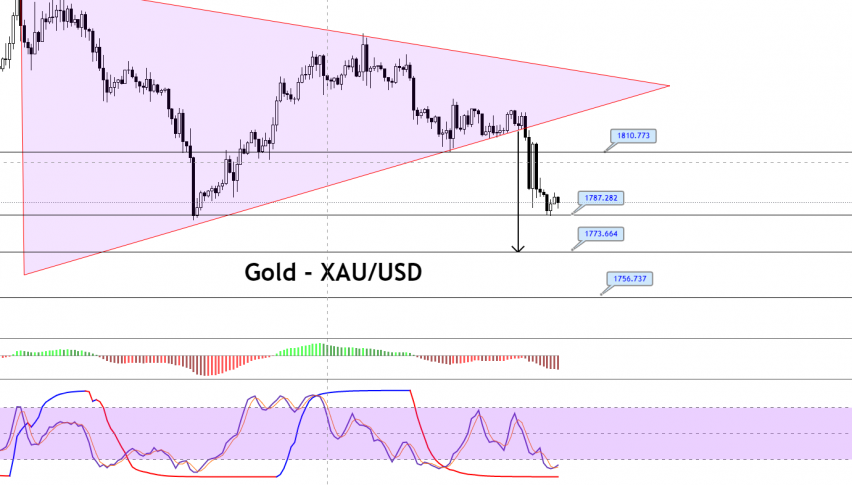

Daily Technical Levels

Support Resistance

1,782.36 1,821.36

1,765.73 1,843.73

1,743.36 1,860.36

Pivot Point: 1,804.73

The prices for the precious metal, GOLD, fell sharply from the 1,814 area, to around 1,786, amid a stronger dollar. On the two-hourly timeframes, GOLD has violated the symmetric triangle pattern, suggesting odds of a strong selling bias until the 1,772 area for now. The immediate support remains around 1,799, which might trigger a slight buying/correction until the 1,800 area, but odds of selling until 1,772 remain solid. Good luck!