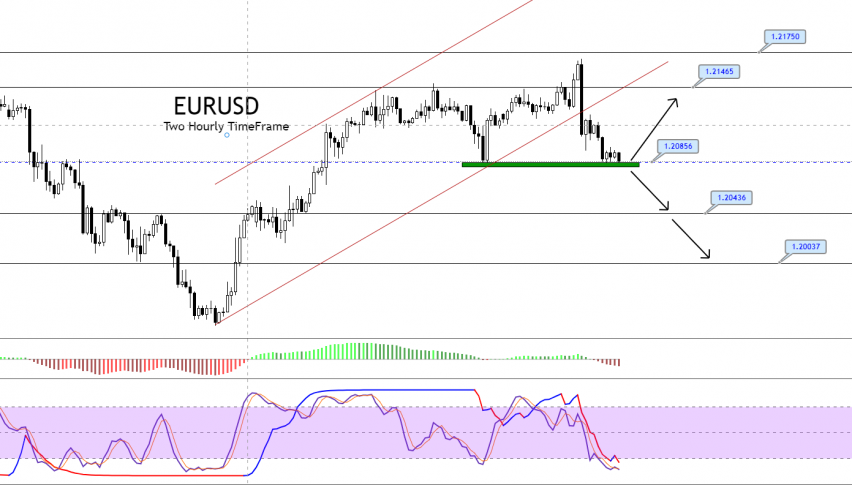

EUR/USD Violates Upward Channel – All Eyes on Double Bottom Support!

The EUR/USD pair was closed at 1.21032 after placing a high of 1.21692 and a low of 1.20948. On Tuesday, the currency pair EUR/USD rose duri

The EUR/USD pair closed at 1.21032, after placing a high of 1.21692, and a low of 1.20948. On Tuesday, the EUR/USD currency pair rose to its highest level since January 27 during the first half of the session, due to better-than-expected macroeconomic data from the European side. However, the EUR/USD pair lost all of its intra-day gains and reversed its momentum in the second half of the day, after the come-back of the US dollar.

During the first half of the day, the greenback stayed under heavy bearish pressure, as risk flows continued to dominate the financial markets. The US Dollar Index (DXY) fell to its lowest level since January 21, at 90.11. However, it managed to reverse its direction in the early American session. During the second half of the day, the US dollar index started rising, and it reached a daily high of 90.64, due to a sharp upsurge witnessed in the US Treasury bond yields.

On the data front, at 14:00 GMT, the Italian Trade Balance was released. It showed a surplus of 6.84B, against the forecasts of 6.25B, supporting the Euro and capping any further downside in the EUR/USD pair. At 15:00 GMT, the Flash Employment Change for the quarter came in, reflecting a drop to 0.3%, against the projected 0.9%, weighing on the Euro, and adding to the losses in the EUR/USD pair. The Flash GDP for the quarter from the Eurozone came in at -0.6%, against the expectations of -0.7%, which supported the Euro and capped the EUR/USD pair’s losses. The ZEW Economic Sentiment from the Eurozone increased to 69.6 in February, against the projection of 59.2, which supported the Euro and put a lid on any further losses in the EUR/USD currency pair. The German ZEW Economic Sentiment also increased, coming in at 71.2, against the expected 59.7, which supported the Euro and limited the decline of the EUR/USD pair.

From the US side, at 18:30 GMT, the Empire State Manufacturing Index for February was released. It came in at 12.1, against the expected 6.2, supporting the US dollar and adding further to the losses in the EUR/USD pair. The poor outlook regarding the coronavirus situation in the Eurozone made investors hesitant to buy too many Euros, which put the EUR/USD currency pair under pressure, resulting in losses. Meanwhile, the safe-haven demand in the market was also lower, as hopes of recovery from the coronavirus crisis all over the globe strengthen, but the uncertainty related to the US economy also weighed on the greenback. Despite the weakness of the US dollar, the rising yields on the US 10-year Treasury note helped keep investors in favor of the greenback, which ultimately weighed on the EUR/USD pair.

Thursday could be the most influential day of the week for the US dollar, as US Retail Sales data could support the greenback considerably if it is in favor of the local currency. Meanwhile, if the Federal Reserve shows any sign of becoming more dovish, the US dollar could weaken again, which would lift the EUR/USD pair.

Daily Technical Levels

Support Resistance

1.2076 1.2151

1.2047 1.2199

1.2000 1.2227

Pivot Point: 1.2123

The EUR/USD pair has extended its trading range from 1.2160 to 1.2080. Violation of this range could drive further movement in the market. A bearish breakout at 1.2080 could lead the EUR/USD price towards the next support area of 1.2042. Conversely, a breakout at the 1.2160 level could extend the buying trend until the 1.2225 level. A mixed bias will prevail today until the breakout occurs. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account