Daily Brief, February 19 – Everything You Need to Know About Gold Today

Gold prices were closed at 1775.71 after placing a high of 1789.61 and a low of 1768.35. After falling for five consecutive sessions to a tw

The expectations for a change in monetary policy, due to some improvement in the economy after shaking off the effects of the coronavirus pandemic, were killed when the Federal Reserve kept its policy unchanged. The central bank held its interest rates close to zero and maintained its policy of a minimum of $ 120 billion in asset purchases every month.

Members of the committee believed that current economic conditions were far from their long-term goals, and to achieve those goals, the policy would need to remain accommodative. All the participants supported the decision to maintain the committee’s current policy, and after the minutes were released, Fed Chair Jerome Powell also announced that the policy stance would remain unchanged, which means that the US dollar will remain under pressure for an extended period, which, in turn, helped the GOLD prices to gain traction.

Meanwhile, on Thursday, Fed Governor Lael Brainard said that financial firms should start addressing climate risk now, as uncertainty about the impact that climate change may have on the financial system should be taken into consideration, and it should not prevent the financial firms from preparing for the shocks to come.

Brainard said that the risks faced by financial firms are not just caused by weather-related disasters, but also potentially by fast changes in the asset prices as a result of policy changes. Central Banks across the globe are trying to determine how climate change will impact on their work.

On the data front, at 18:29 GMT, the Philly Fed Manufacturing Index for February came in, indicating a rise to 23.1, against the expected 20.3, which supported the US dollar and capped any upside in GOLD.

At 18:30 GMT, the Building Permits for January were released. They rose to 1.88M, against the expected 1.67M, and supported the greenback, limiting the upside momentum in gold. In January, the Housing Starts declined to 1.58M, against the projected 1.66m, weighing on the greenback and helping the yellow metal to remain positive. In January, the Import Prices rose to 1.4%, against the expected 1.0%, boosting the US dollar. The Unemployment claims from last week also increased, coming in at 861K, against the expected 775K, which weighed on the US dollar, and supported the upward momentum in the gold prices.

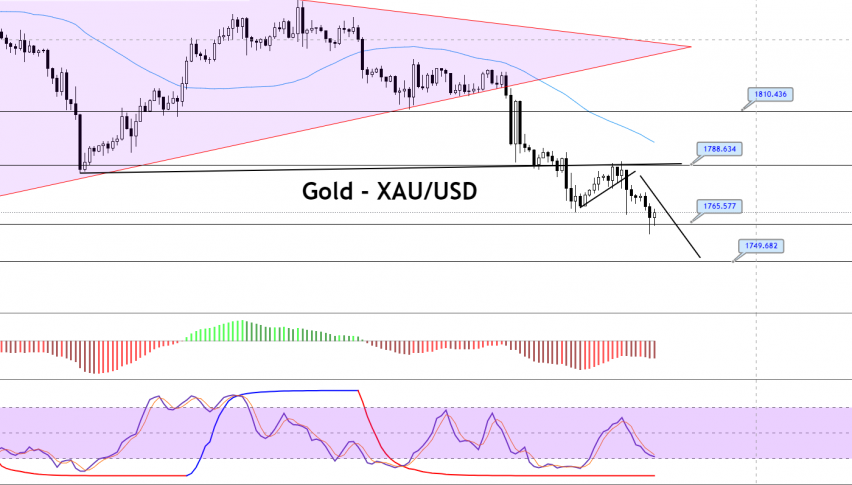

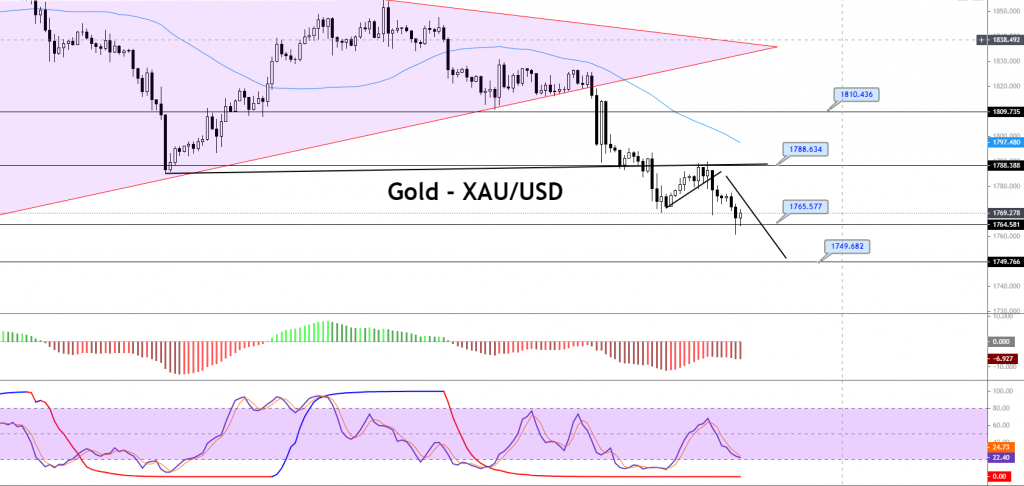

Support Resistance

1,762.40 1,788.70

1,752.00 1,804.60

1,736.10 1,815.00

Pivot Point: 1,778.30

On Friday, the precious metal, GOLD, continues to trade with a bearish bias at the 1,769 level. The yellow metal has already violated a support level of 1,790, which is now working as resistance. On the 8-hour timeframe, the support was extended by an upward trendline. However, the closing of candles below 1,790 may drive further selling in GOLD, until the 1,763 level. A bearish breakout at 1,769 could drive a further selling trend until 1,752. A bearish bias seems dominant today.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account