Daily Brief, February 24 – Everything You Need to Know About Gold

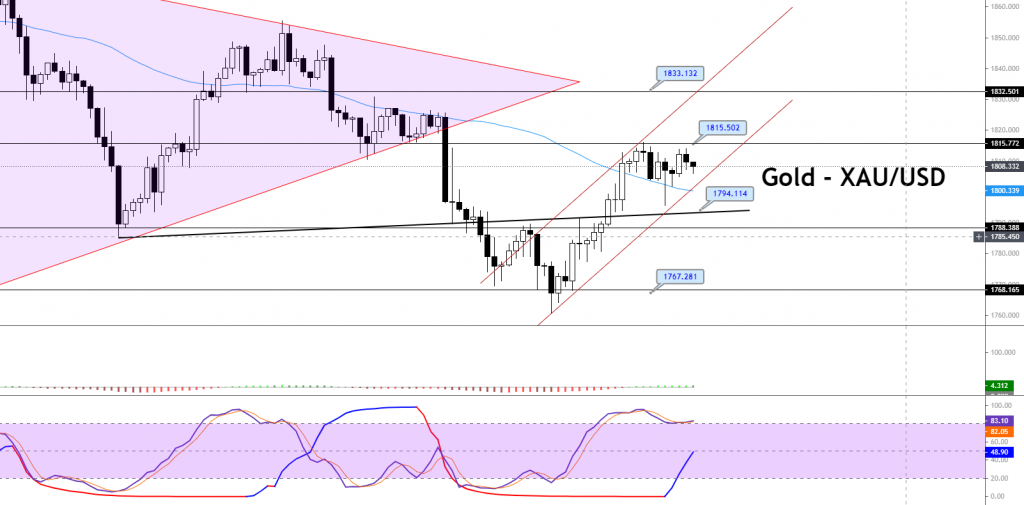

Gold is trading at 1,810 level, mostly exhibiting choppy sessions. On the higher side, gold is likely to find an immediate resistance at...

The closely watched consumer confidence report from Conference Board Inc. showed that financial confidence, which is also a leading indicator of consumer spending, has been improving in February, supporting the US dollar and ultimately adding to the losses in the yellow metal prices. Meanwhile, Fed Chair Jerome Powell testified before the US Senate Banking Committee on Tuesday, where he acknowledged that progress in terms of vaccinations and easing in the number of new coronavirus cases will result in fast growth of the economy.

Powell pushed back on suggestions that a loose monetary policy would result in a risk of unleashing inflation and financial risks in the emerging economic boom. This came after a Republican senator expressed concerns that the combination of Fed asset purchases, the ongoing economic boom, due to vaccine optimism, and another massive stimulus package, could drive prices to unsustainable levels and spark inflation. However, Powell tried to persuade the markets that a strengthening economy does not necessarily mean that the rates have to rise. Powell said that the interest rates would remain low, and the Fed’s $ 120 billion in monthly bond purchases would continue until further progress has been made towards achieving the Fed goals. He also said that the price pressure remained mostly muted, and that the economic outlook was still highly uncertain. According to the Fed chief, the economy was a long way from achieving the Fed’s employment and inflation goals, so it would take some time before substantial further progress could be achieved.

After Powell’s comments, a recent sharp rise in Treasury bond yields increased inflation hopes. The rising yields, in turn, supported the US dollar, putting pressure on the gold prices on Tuesday. However, the greenback started losing strength as markets recognized Powell’s dovish tone, and further losses in the precious metal were stopped. Furthermore, the Governor of the Federal Reserve, Michelle Bowman, said late on Monday that the US economy had recovered substantially from the effects of the COVID-19 pandemic; however, working women and the communities of low-income and colored families continued to be hard-hit by the effects of the pandemic.

Bowman said that the improvement in the economy has been uneven, as some households are still struggling with unemployment and they are suffering financial difficulties. These comments added weight to the US dollar, but failed to reverse the downward momentum in the gold prices on Tuesday.

Support Resistance

1,787.20 1,821.00

1,766.00 1,833.60

1,753.40 1,854.80

Pivot Point: 1,799.80

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account