US Dollar’s Appeal Weakens as Traders Turn to Riskier Currencies

The US dollar is trading bearish on Wednesday, falling to the lowest level seen in three years against commodity currencies and the GBP

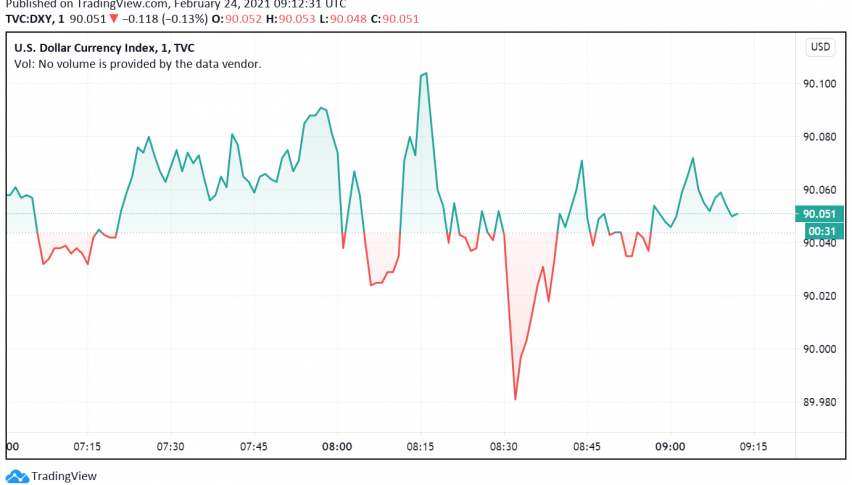

The US dollar is trading bearish on Wednesday, falling to the lowest level seen in three years against commodity currencies and the GBP as the market sentiment improves over rising hopes for the global economy to recover from the pandemic-driven downturn. At the time of writing, the US dollar index DXY is trading around 90.05.

During the previous session, Fed chair Jerome Powell once again stated the central bank’s intent to hold interest rates close to zero and continue with its bond purchase program until the US economy makes a full recovery. The extended dovishness of the Fed is likely to keep exerting downward pressure on the US dollar in the near future.

Meanwhile, the optimistic mood in global markets is driving investors away from the safety of the greenback and towards riskier currencies that could gain the most from an improvement in the overall economic outlook and global trade. Countries that are rapidly rolling out the COVID-19 vaccines and could see their economies rebound faster are also seeing greater interest in their respective currencies among traders.

In addition, the positive mood has also driven up prices of commodities across the world, which has boosted the appeal of commodity currencies, especially the AUD and NZD. The GBP, meanwhile, has been trading strong on the back of vaccine optimism driving up hopes for easing of lockdowns and restrictions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account