Daily Brief, February 25 – Everything You Need to Know About Gold!

The precious metal gold closed at 1804.74 after placing a high of 1813.77 and a low of 1783.52. Gold prices fell in the beginning session on

GOLD closed at 1,804.74, after placing a high of 1,813.77, and a low of 1,783.52. The GOLD prices fell during the first session on Wednesday, remaining lower, but during the late hours, the precious metal rebounded, recovering all the losses and ending the day at the same level on which it started, which resulted in flat movement for the day. The rising US Treasury yields weighed heavily on GOLD, which is considered a hedge against inflation. The greenback came under pressure on Wednesday after the latest comments by Fed officials, who said that the economy was far from inflation and employment goals, and that there was a long road ahead to recovery. These comments weighed on the US dollar, but the rising US Treasury yields capped the gains in the yellow metal on Wednesday.

On the data front, at 20:00 GMT, the New Home Sales for January came in, indicating a rise to 923K, against the expected 853K, which supported the US dollar and added to the slump in the gold prices. On Wednesday, Federal Reserve Governor Lael Brainard said that the US economy was far from the Federal Reserve goals for employment and inflation, and monetary policy would continue to provide full support until further progress had been made in raising inflation and improving the labor market for all workers. She said that it would take time before the inflation and employment goals set by the Fed would be met. She also added that policymakers were looking beyond the headline unemployment rate when assessing the health of the labor market, and that it was recovering from the pandemic unevenly.

According to the new framework announced last August, Fed officials will no longer increase the interest rates when the unemployment rate is low, in the projection of higher inflation, which will allow more time for the labor market to heal. Brainard said that when assessing the labor market, policymakers would look at wages, the employment to population ratio and the labor force participation rate, along with the other indicators. She also said that the support would remain in place until inflation came back on track, close to 2% or above this target.

Furthermore, on Wednesday, the Vice-Chair of the Federal Reserve, Richard Clarida, said that despite the very near-term downside risks to the US economy, as a result of the coronavirus pandemic and new variants of the virus, both the fiscal relief package from last year and the effective vaccines had set the tables for more robust growth and better prospects for the economy in 2021 and beyond. He said that the improved prospects had diminished the downside risks to the economic outlook. He also confirmed that the Fed was committed to using the full range of tools to support the economy and help ensure that the recovery from the pandemic is as robust and rapid as possible.

Federal Reserve Chairman Jerome Powell began two days of Congressional testimony on Tuesday. He presented a report to the Senate Banking Committee on Tuesday and spoke before the House Financial Services Committee on Wednesday. Powell said that inflation was soft and that the US economy was a long way from the Fed’s employment and inflation goals. He also downplayed concerns about whether recent policy decisions and a post-pandemic boost in consumer spending would lead to higher inflation. Powell did not expect that a situation would arise, in which inflation would increase to troublesome levels.

After this, the US Treasury yields started to rise on Wednesday, with the 10-year Treasury note reaching 1.4%, which is its highest level since February 2020. The 30-year Treasury bond also rose, coming in at 2.25%. The rising Treasury yields on Wednesday gave the yellow metal prices a boost.

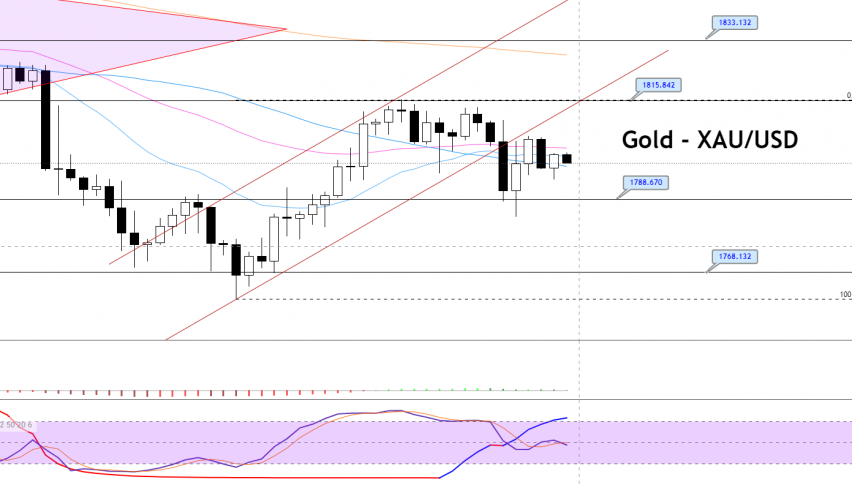

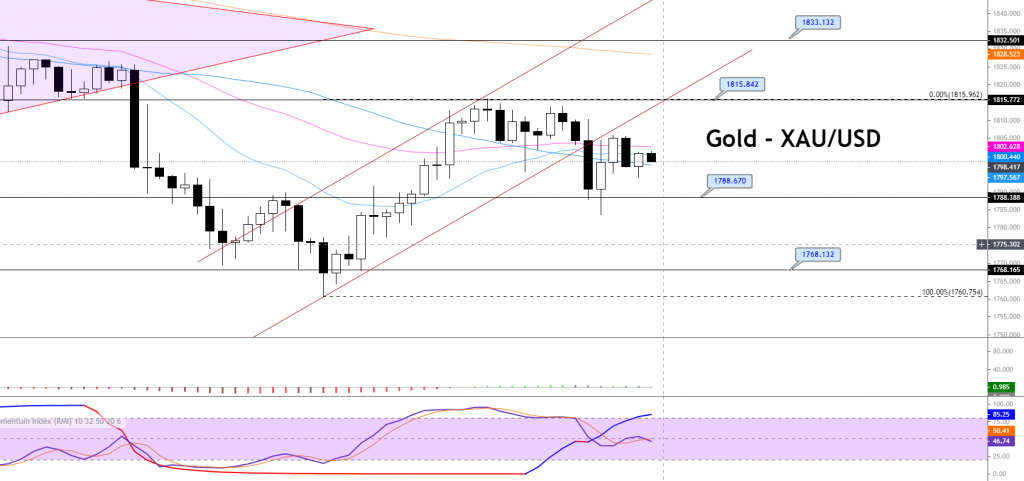

Support Resistance

1,795.20 1,815.90

1,784.50 1,825.90

1,774.50 1,836.60

Pivot Point: 1,805.20

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account