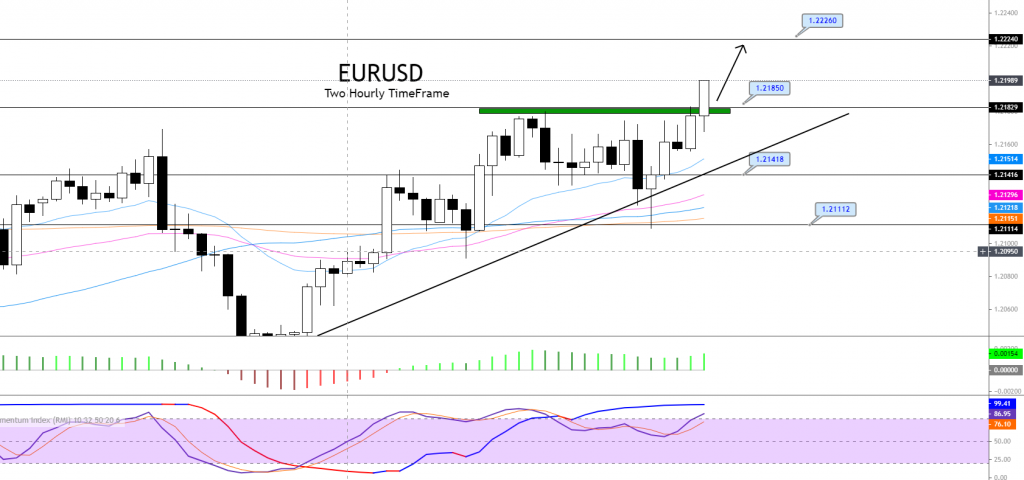

EUR/USD Violates Ascending Triangle Pattern – Brace for a Bullish Trade!

The EUR/USD pair was closed at 1.21680 after placing a high of 1.21744 and a low of 1.21089. The EUR/USD pair posted gains on Wednesday afte

The EUR/USD currency pair closed at 1.21680, after placing a high of 1.21744, and a low of 1.21089. The EUR/USD pair posted gains on Wednesday, after falling to its lowest level in two days during the early trading hours of the day. However, the currency pair EUR/USD managed to recover its losses and changed its course in the second half of the day.

The uncertain outlook in the Eurozone has kept the EUR/USD under pressure, whereas the broad weakness of the US dollar has helped the pair climb higher this week. The single currency Euro has been under pressure due to the broad-based strength in its rival currency, the British Pound, and the concerns about the coronavirus in the Eurozone. This downward pressure on the single currency has made it difficult for the Euro to capitalize on the losses in its other great rival, the US dollar.

The Eurozone was already suffering from the delays in the rollout of coronavirus vaccines, and with the current lockdown situations across the bloc, it continues to face uncertainty with regard to how long the pandemic is going to impact the economy. The Euro also came under pressure after the vaccine producer AstraZeneca let the EU down, saying that it would only deliver around half the original estimated number of vaccines in Q2. All these factors kept the EUR/USD pair under pressure during the first half of the day on Wednesday.

However, the EUR/USD currency pair managed to recover its losses, rebounding in the second half of the day, on the back of the broad-based weakness of the greenback. The US dollar continued to be one of the weakest major currencies on the market on Wednesday, as investors were more willing to take risks on hopes of recovery from the coronavirus, rather than buying the safe-haven US dollar. The uncertainty surrounding the domestic economic outlook in the US also weighed on the greenback. The latest comments by various Fed officials, including Fed Chair Jerome Powell, also put further pressure on the US dollar

All of the officials confirmed that the US economy was still far from reaching the employment and inflation goals set by the Federal Reserve. The expectations that inflation will reach troublesome levels were also downplayed by Fed officials, whose comments triggered a spike in US Treasury yields, lifting the Treasury yield on the 10-year note to its highest level it two years, above 1.42%. The greenback also gathered strength from the rising yields but remained in negative territory due to the improved market risk sentiment. The weakness of the US dollar pushed the EUR/USD currency pair higher on Wednesday.

On the data front, at 12:00 GMT, the German Final GDP for the quarter came in, showing an increase to 0.3%, against the forecast of 0.1%, supporting the Euro and adding further gains for the EUR/USD pair. From the US side, at 20:00 GMT, the New Home Sales for January were released, indicating a rise to 923K, against the expected 853K, which supported the US dollar and capped any further upside momentum in the EUR/USD pair.

Support Resistance

1.2129 1.2175

1.2110 1.2200

1.2084 1.2220

Pivot Point: 1.2155The EUR/USD pair is currently trading with a bullish bias, as it has violated the resistance level of 1.2185. On the higher side, a continuation of the bullish trend could extend buying until the next target area of 1.2260. The recent bullish engulfing pattern is likely to keep the EUR/USD pair in a bullish mode, and it may drive strong buying in the pair. Thus, we are opening a buy signal to trade bullishly over the 1.2198 area. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account