US Dollar Weak as US Treasury Yields Dip, Risk Appetite Returns

he US dollar is exhibiting signs of weakness, following a decline in US Treasury yields which have also improved the risk appetite in global

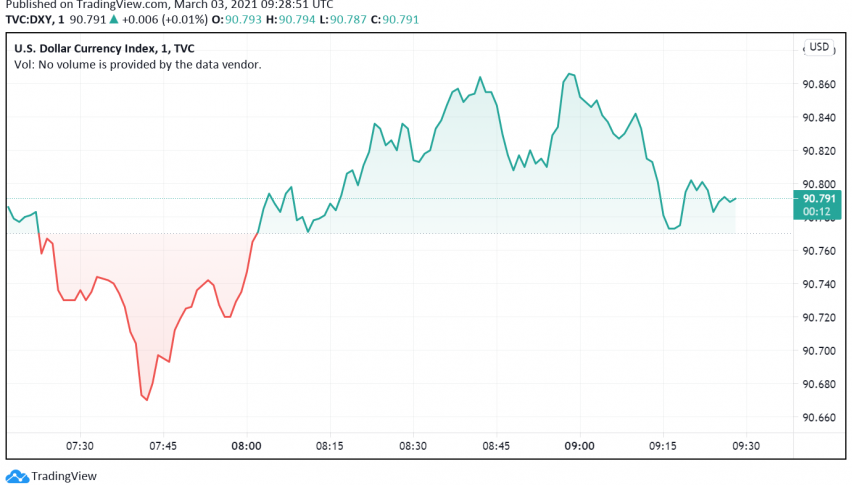

Early on Wednesday, the US dollar is exhibiting signs of recovery after some weakness, following a decline in US Treasury yields which have also improved the risk appetite in global markets and further dented the safe haven appeal of the reserve currency. At the time of writing, the US dollar index DXY is trading around 90.79.

The past few weeks have seen considerable volatility in global markets over fears that various stimulus measures would stoke reflation, causing a jump in government bond yields around the world. The heightened uncertainty surrounding high inflation as global economies begin to recover from the pandemic-inflicted damage had caused stock markets to reverse their rallies and even hit commodity prices.

Meanwhile, the US is gearing up for another round of fiscal stimulus with President Biden’s proposed $1.9 trillion worth of pandemic relief inching closer to its rollout. The possibility of more stimulus is exerting additional downward pressure on the US dollar, turning it bearish against its major peers.

Later this week, expect more volatility in markets on the release of the latest NFP report. Markets will look for cues about the state of the US economy and its recovery, which could boost investor confidence and cause another round of sell-off in bonds.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account