Dramatic Dip in the EUR/USD – Brace for a Correction!

The EUR/USD pair dropped sharply on Thursday and reached below 1.2000 level on the back of broad-based strength in the U.S. dollar amid the

The EUR/USD pair fell sharply on Thursday, dropping below the 1.2000 level, on the back of the broad-based strength in the US dollar, following the comments by the Chairman of the Federal Reserve, Jerome Powell. Furthermore, the dismal macroeconomic data from the Eurozone also added to the losses in the EUR/USD pair.

On Thursday, Fed Chair Jerome Powell said that there were chances that inflationary pressure could be seen in the coming months; however, it would not be enough to force the Federal Reserve to raise interest rates. He expects that inflation will pick up with the reopening of economies, due to the base effect in the coming months, which could exert upward pressure.

After Jerome Powell’s comments, the markets started to fall, as the stock prices dropped and the US Treasury yields rose. The markets were expecting a few remarks regarding the rising prices of yields by the Fed Chair, but when he refrained from talking about them, the market traders were disappointed and they started selling off risky assets. The EUR/USD pair is a riskier currency pair that also suffered, moving along with the sentiment and ultimately dragging the prices for the pair below the 1.200 level on Thursday.

From the US side, at 17:30 GMT, the Challenger Job Cuts for the year came in at -39.1%, against the previous 17.4%. At 18:30 GMT, the Revised Nonfarm Productivity for the quarter was released, showing a decline to -4.2%, against the projected -4.7%, which weighed on the US dollar and capped the losses in the EUR/USD prices. The Revised Unit Labor Cost for the quarter also declined, coming in at 6.0%, against the projected 6.7%, putting downside pressure on the US dollar and limiting the downward momentum in the EUR/USD pair. The Unemployment Claims for last week fell to 745K, against the projected 758K, boosting the US dollar and adding further to the losses in the EUR/USD pair. In January, the Factory Orders rose to 2.6%, against the projected 2.2%, which supported the US dollar and added more downward momentum for the EUR/USD on Thursday.

On the Euro front, the investors were still concerned about the outlook in the Eurozone, as it appeared to be heading for a double-dip recession. The restrictive measures on the retail sector in most of the larger Eurozone economies continued to weigh on the economy. The retail shutdown in the Netherlands and Germany began in December and lasted throughout January, causing a sharp decline in activities. These developments weighed on the Euro currency, ultimately dragging the EUR/USD pair to the downside.

Furthermore, the confidence in Eurozone economic recovery was also waning because of the delay in rolling out the coronavirus vaccines in the bloc. This has also been weighing on the single currency Euro, ultimately supporting the bearish momentum in the EUR/USD pair.

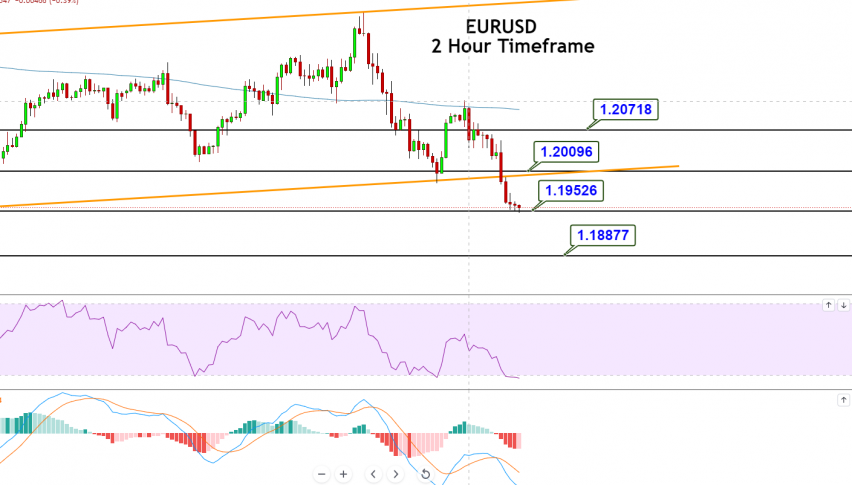

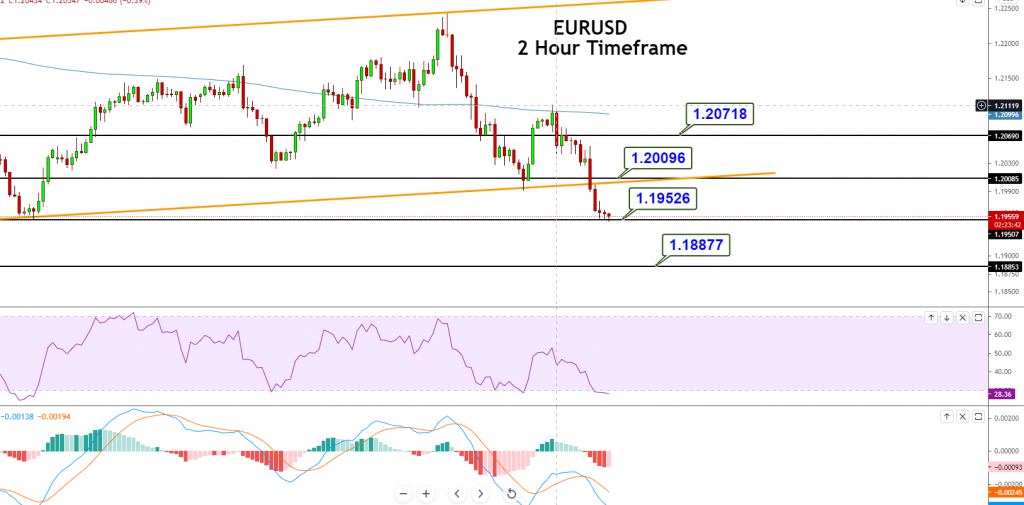

Support Resistance

1.2033 1.2104

1.2002 1.2144

1.1962 1.2175

Pivot Point: 1.2073Trading in the EUR/USD was sharply bearish, amid a stronger US dollar, and now it is likely to find support at the 1.1950 level. Below this, the EUR/USD may find its next support at 1.1887. At the same time, the pair may find resistance at 1.2010. The US NFP will determine the next moves; however, the bearish bias is likely to dominate the market before the figures are released. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account