US Dollar Rises Again as Treasury Yields Spike – Inflation in Focus

The US dollar is holding strong against its major rivals, rising above the highest levels touched in a week, as US Treasury yields surged

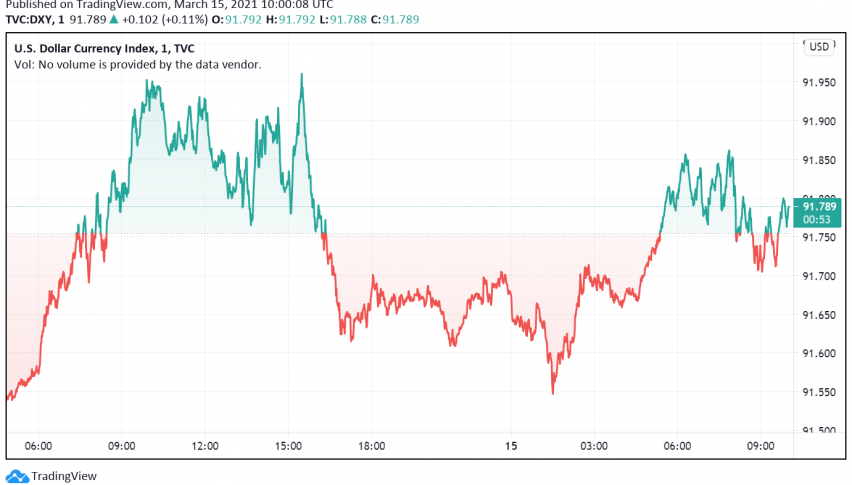

Early on Monday, the US dollar is holding strong against its major rivals, rising above the highest levels touched in a week, as US Treasury yields surged to over one-year highs as concerns about high inflation plague the sentiment in financial markets again. At the time of writing, the US dollar index DXY is trading around 91.78.

Against the safe haven currency Japanese yen, the dollar surged to the highest level seen since June 2020, driven higher by the spike in US Treasury yields. The benchmark 10-year US Treasury yields strengthened to above 1.62%, approaching Friday’s high of 1.642%.

The US dollar has experienced considerable volatility in recent sessions amid the spike in treasury yields even as markets await to see the impact of the latest round of fiscal stimulus measures. Last week, President Biden signed his $1.9 trillion COVID-19 relief package into law, and while this can speed up US’s economic recovery, it could also weaken the safe haven appeal of the reserve currency.

In addition, the latest round of financial aid has markets worried about the possibility of a spike in inflation, even as the Fed maintains its monetary easing. This sentiment has also contributed to the recent rise in treasury yields, which is keeping the dollar supported against other currencies, even as the overall risk sentiment in markets improves on hopes for the vaccines driving global economic recovery.

The US dollar also received a boost by optimistic economic data releasing late last week, with PPI rising to the highest levels seen in almost two and a half years. In addition, the rapid rollout of the COVID-19 vaccines across the country and Biden’s assurance for strengthening the rollout have also improved the outlook for the US economy and supported the bullishness in the currency against its major peers.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account