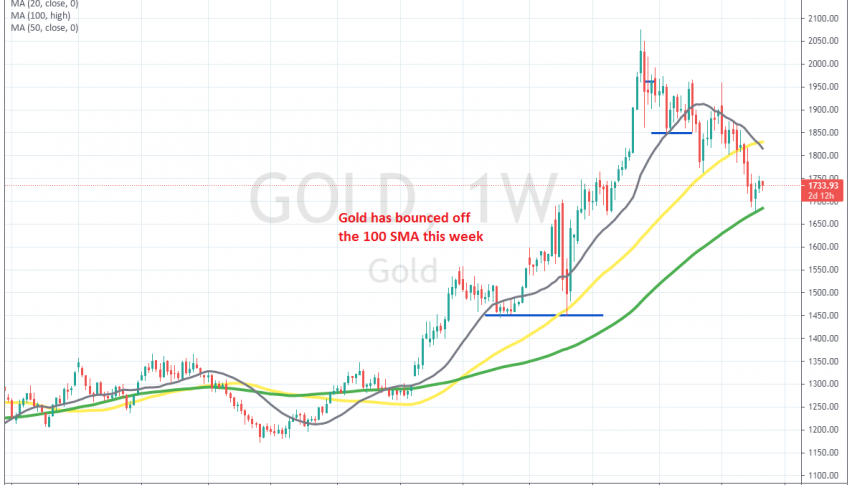

Gold Bouncing Off the 100 SMA, But the Jump Seems Weak

Gold has turned quite bearish, but this week we are seeing a bonce off the 100 SMA

Gold turned bearish in August last year, after being really bullish for two years. The breakout of the coronavirus sent safe havens such as Gold even higher, making some record highs in August, as it pushed above $ 2,000.

Although, GOLD started turning lower in the second week of August, despite the heightened uncertainty all over the world. But, cryptocurrencies stole the safe haven status from precious metals and Gold lost its appeal.

It found support at moving averages as it slid lower, but they didn’t hold for too long and were eventually broken. Although, the 100 SMA (gray) turned into support for Gold on Monday and in the last two days we have seen a bounce off that moving average.

Although, the bounce seems weak and today the bounce is already fading. So, this bounce seems like a good opportunity to go short on Gold, but I would like to see the 20 SMA (gray) catch up on the daily chart, before going short on Gold. The 20 SMA is still some distance away from the current price, but we will follow the price action.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account