US Dollar Gains – Economic Recovery Hopes, Strong Data Support

At the start of a brand new trading week, the US dollar is holding strong against its major peers, especially the Euro over increased

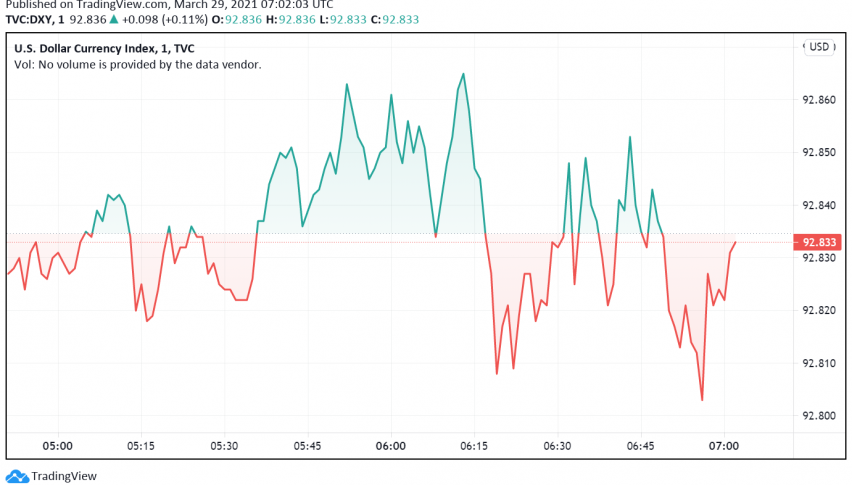

At the start of a brand new trading week, the US dollar is holding strong against its major peers, especially the Euro over increased investor confidence in the US posting a faster economic recovery than most other parts of the world. At the time of writing, the US dollar index DXY is trading around 92.83.

The Euro has slipped to an over four-month low against the greenback and is all set to post the worst ever monthly performance in nearly two years as a result of the latest wave of the pandemic and resultant lockdowns. Meanwhile, the safe haven currency Japanese yen is also holding close to the lowest levels seen in 10 months over concerns about widening gaps between US and Japanese government debt, which has surged to an over one-year high as US Treasury yields strengthen lately.

In early trading on Monday, the US dollar has also made gains against riskier currencies like the AUD and the NZD, which had strengthened in the previous session over an upbeat market sentiment. So far in Q1 2021, GBP/USD has strengthened by 0.8% over hopes that the robust vaccine rollout across Britain would boost its economic recovery.

In addition to the rising optimism about economic recovery, the US dollar has also enjoyed support from recent data releases that have come in better than expected and aided its bullishness. During the previous week, jobless claims across the world’s most powerful economy fell to the lowest level seen in a year even as President Biden has offered assurances of strengthening the vaccine rollout further in the coming weeks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account