EUR/USD Choppy Session Continues – Brace for a Breakout Trade!

The EUR/USD pair closed at 1.17298 after placing a high of 1.17598 and a low of 1.17041. After declining for the last two days, the pair

The EUR/USD pair closed at 1.17298 after placing a high of 1.17598 and a low of 1.17041. After declining for the last two days, EUR/USD reversed and ended Wednesday with gains. In early trading hours of the day, the currency pair rose and reached near its previous day’s high, but it could not remain there for long and reversed its direction in the second half of the day. Still, the currency pair managed to end its day with minimum gains on its side.

The rise in EUR/USD was followed by the recent decline in US dollar and Treasury yields, the US Dollar Index fell to 93.2 level, and the yields on the US 10-year Treasury note also declined to 1.73% on Wednesday that ultimately weighed on the US dollar and pushed the currency pair higher. However, the single currency euro cut its gains against the US dollar in the second half of the day after investors worried over fresh lockdown measures in the economic bloc that will slow the recovery process.

On Wednesday, French President Emmanuel Macron said they could lose control if they did not take serious action now. So, France widened its lockdown measures nationwide to curb the effects of the third wave of coronavirus and closed schools and non-essential shops for three more weeks. The number of infected persons topped 5,000 in France on Tuesday. On the data front, at 11:45 GMT, the French Consumer Spending dropped to 0.0% against the expected 1.2% and weighed on the single currency Euro that capped further gains in the EUR/USD pair. The French Prelim CPI also dropped to 0.6% against the forecast 0.7% and weighed on the Euro. At 12:55 GMT, the German Unemployment Change dropped to -8K against the expected -4K and supported Euro and added further upside momentum in the pair. At 14:0 GMT, the CPI Flash Estimate for the year declined to 1.3% against the expected 1.4% and weighed on Euro. The Core CPI Flash Estimate also declined to 0.9% against the projected 1.1% and weighed on Euro and limited the upward movement in this pair.The Italian prelim CPI raised to 0.3% against the projected 0.1% and supported the single currency Euro and added further gains in EUR/USD. From the US side, at 17:15 GMT, the ADP Non-Farm Employment Change for March declined to 517K against the forecast 552K and weighed on the US dollar that added further gains in this currency pair. At 18:45 GMT, the Chicago PMI surged to 66.3 against the expected 61.2 and supported the US dollar that capped further upside. At 19:00 GMT, the Pending Home Sales fell to -10.6% against the projected -3.1% and weighed on the US dollar that added strength to this pair.

On the other hand, a pullback in EUR/USD prices in the second half of the day could also be attributed to US President Joe Biden’s latest announcement about the $2 trillion infrastructure plan. The total plan was worth $4 trillion, but it was split into two small plans. This plan, along with the $1.9 trillion as a stimulus relief measure, increased the prospects for quick economic recovery and supported the US dollar that ultimately dragged the pair prices.

Support Resistance

1.1702 1.1759

1.1674 1.1788

1.1645 1.1816

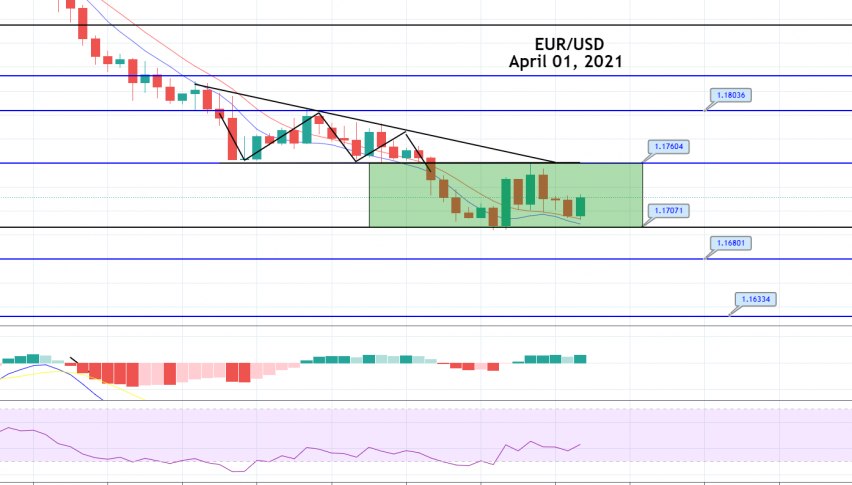

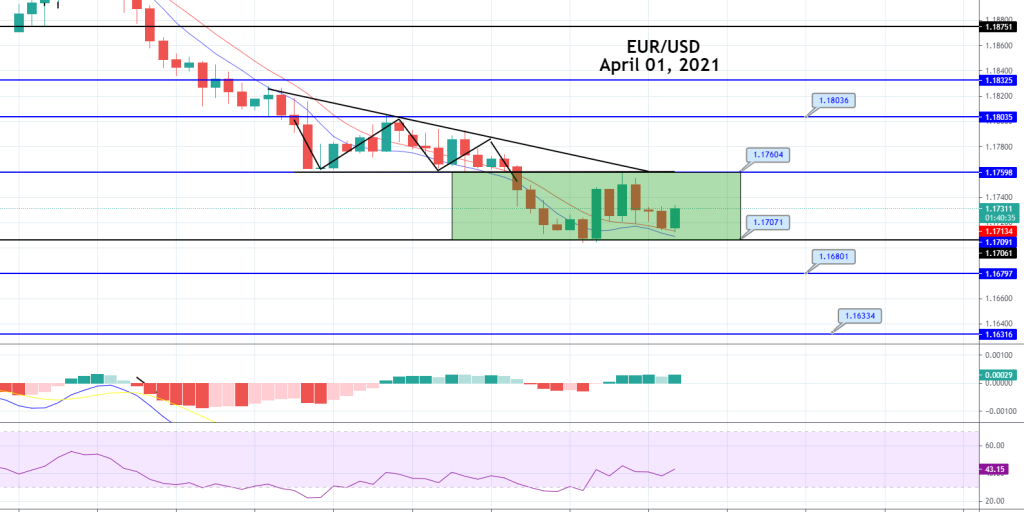

Pivot Point: 1.1731The EUR/USD pair is trading with a bearish bias at 1.1711 level, having violated the support area of 1.1725 level. EUR/USD may find some support around the 1.1686 level. The bearish engulfing candle’s recent close is likely to drive selling trade in the pair. On the higher side, it is likely to face resistance at the 1.1725 level. Bullish bias can dominate over 1.1725, and bearish bias stays strong below 1.1725 level today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account